Lux Luthor's Secret Worship of Mammon— Part 1: How New Zealand's Prime Minister Drives the Economy like a Crazed Valiant Enthusiast, Maintaining Poverty to Serve the Oligarchy

And Why the Zoned-Out NZ Monkey is a Programmed Debt-Enslaved Test Subject

The dirty secrets underpinning the nexus between banking, politics and big business are unpacked in this heretical snoop-dispatch of December 31 2024.

New Zealand’s very own Snoopman snoop-splains how Prime Minister Christopher Luxon is able to get away with driving the economy like a crazed Valiant enthusiast.

Former Māori Television news and current affairs editor Steve Snoopman reveals how the management of poverty is weaponized as a tool of propaganda, to mask why the New Zealand Government maintains a threshold level of unemployment to serve the power of the Civil Oligarchy, who use their enormous wealth to steer politics.

He shows how N.Z.’s Government maintains this threshold level of unemployment by influencing interest rates through the Reserve Bank in cahoots with the Treasury. By maintaining a visible level of poverty, this hidden mechanism of social control weakens the pay-bargaining power of wage and salary earning monkeys.

Using snoop auto-metaphors, Snoopman demystifies arcane economic processes that are designed to keep the New Zealand Monkey (genus Homo small isle sapien retardus) either trapped in poverty, or hovering above poverty, or disempowered in a ubiquitious system of totalitarian democracy, that entrains notional freedom.

Moreover, this economic warfare drives ‘Kiwis’ to take flight. On Lux Luthor’s watch, the drive to slash inflation by scuttling employment has driven almost 130,000 Kiwis out of the plantation economy, over the year to November 2024.

He finishes by snoop sign-posting how Homo small isle sapien retardus can embark on a journey of political puberty — without needing to obtain anyone’s permission.* By finding the inner resolve to participate in the emancipatory evolution of the human monkey, New Zealand Monkeys can ‘flip the switch’ on the South Pacific archipelago’s role as a test lab for the ‘developed world’, to trail-blaze self-autonomy.

*Over time, the New Zealand Monkey has become genus Homo small isle sapien retardus, since we are as a people easily governable. We are also getting screwed, daily.

Key Finding: The New Zealand Government indirectly regulates the level of unemployment in order the dampen the earning power of wage and salary monkeys, since higher pay packets drive up inflation, which eats up corporatre profit margins. The level of (un)employment is controlled via the Reserve Bank wholesale interest rate as the price charged to the banking industry to buy new currency. In turn, the interest rates the banking industry charges to ‘borrowers’, regulates whether there is more or less news loans created, which determines economic activity and job levels.

The dirty secret of banking is that bank ‘loans’ are manufactured credit. By maintaining an artificial scarcity of cash and an abundance of privately manufactured credit, the cartelized banking industry forces households, enterprises and governments into a life of debt, taxes and servitude. This debt bondage game serves a hidden purpose of making land scarce to as many Tax Monkeys as possible.

Note: Updated 10 February 2025 to accommodate the latest Statistics NZ net migrations data.

Apprentice Level ‘Spanner in the Works’ Explainer

Snapshot: The Reserve Bank, Treasury and the banks industry set interest rates to stimulate or cool the economy, thereby maintaining persistent structural unemployment, to sustain cheap credit to serve the Civil Oligarchy.

Since he became New Zealand’s Prime Minister in October 2023, Christopher Luxon has metaphorically ridden the employment break pedal with his left foot, while simultaneously riding the loans accelerator with his right foot, of a manual Valiant.

The National Party leader — whose net worth hovers around $40 million — has all the while kept one eye on the inflation water gauge, while he has also kept his other eye on the unemployment oil gauge, of his Valiant Charger (assembled by Todd Motors).*

Chris Luxon, AKA Lux Luthor, has been driving the economy like a crazed Valiant enthusiast because New Zealand’s Rich-Listers (domestic and foreign) prefer low levels of inflation of around 1% to 3%, which requires maintaining unemployment in the margin of between 4% to 6% of the ‘workforce’. The monetary tool used to regulate the level of inflation, is the central bank’s wholesale credit rate, which is the price the Reserve Bank charges to ‘lending’ the N.Z. dollar currency to the banking industry.

Yet, only a segment of the TVNZ Crown-owned Q+A current affairs programme —with sufficient economic literacy — would have been privy to how the Government’s Reserve Bank, the Treasury and the banking sector controls inflation by regulating the level of (un)employment via the central bank’s blandly termed ‘official cash rate’.

Because most New Zealand Monkeys, genus Homo small isle sapien retardus, suffer from economic illiteracy, many among the audience of Q+A would only have understood that excess government spending causes high inflation. While this is true, particularly if the money doesn’t result in increased economic activity, but instead merely inflates fuel or food prices, property values, or supports the working population who have been shoved into welfare, as happened on mass during the Corona Crisis shutdowns.

Yet, Luxon avoided explaining why exactly in such expenditure-induced inflation, you have to “take interest rates up”, and this causes an economic recession and it leads to unemployment. Several times, the Catholic politician claimed “we” have had to relearn “the immutable laws of economics”. He also said fiscal conservatives care about working people, which is fascinating because he displays the characteristics of a narcissistic personality type. Narcissists perform cognitive empathy, fake sincerity and seek to control to gain constant emotional supply. Politics attracts narcissists.

* As far as the Snoopman knows, Chris Luxon doesn’t drive a Valiant. This scenario is purely metaphorical and is an image-creating way to demystify the New Zealand Edition of Monopoly, since most monkeys domiciled in the South Pacific archipelago suffer from economic illiteracy. This condition blocks a quest to strive for their emancipatory evolution, since the perceived virtue of blissful ignorance acts as a political puberty blocker. Chrysler Valiants were manufactured in Australia and assembled at Todd Motors — as any car geek knows. Evidently, these immutable laws were first learned 35 years ago, which would correspond with one year prior to the Bolger National Government winning power.

This timeframe also corresponds with the end of the Lange Labour Government’s five year-tenure from 1984 to 1989, that inflicted unmandated economic warfare upon New Zealand on behalf of the Civil Oligarchy, to execute a corporate heist of the economy.

Luxon was referring to the Reserve Bank gaining its inflation targetting power in 1989.

The brutal truth is New Zealand maintains a debt-enslavement monetary system designed to serve the Civil Oligarchy, who syphon off the wealth with interest-bearing credit. The super-wealthy prefer a low inflation band, because this economic factor provides the conditions for stable prices, such as labour costs, fuel costs and leases.

The Civil Oligarchy enjoys access to cheap credit. The banking elites will signal to state managers the desired economic policies with the level of interest rates, which in turn regulate the level of inflation by dampening or expanding economic activity.

The higher the interest rate, the less that ‘loans’ are authorised to ‘borrowers’, because less borrowers will be able to meet the payments, since the competition pressure to find the cash to meet the higher interest charges will be more fierce. Ergo, higher interest rates dampens economic activity. Less ‘borrowers’ qualify for new ‘loans’.

When it is comprehended that a monetary system based on debt, that it is only the principal component of the loan that out into circulation at the time loan contract is created, then the fierce competition to maximize profits to make enough coin to pay the interest component of loans issued across an entire economy, becomes apparent.

Thus, this regulation of interest rates indirectly regulates the level of (un)employment.

Since more ‘loans’ are authorised to ‘borrowers’ when the interest rates are lower, it follows that this increased credit creation boosts economic activity and employment.

This hidden state policy of ‘structural unemployment’ is a key component of the poverty crisis, itself a catastrophe borne from deliberate strategic sabotages of industry to inflict discretionary idleness, as I showed in Discretionary Idleness: Structural Unemployment as a Shock Doctrine Economic Warfare Tool in Neo-Colonial New Zealand. Once the Reserve Bank gained the power to target inflation in 1989, the collusion between New Zealand’s central bank and Treasury and the transnational banks was formalized. This collusion was dubbed as an experiment in central bank ‘independence’, as occurred on the watch of Governor Don Brash (1988-2002).

Between them, the Reserve Bank, Treasury and the transnational banks set interest rates to stimulate or cool the economy, thereby maintaining conditions for persistent structural unemployment. On the watch of the Bolger National Government, Don Brash and Finance Minister Ruth Richardson scuttled employment to drive inflation down, just as had occurred on Lange’s watch, without explaining the mechanisms.

If we think of Reserve Bank Governor’s annoucements of adjustments to the Official Cash Rate (OCR) as the act of engaging the clutch, to change the gear of the manual Valiant Charger, then such annoucements signal a rise or fall in the wholesale cost of this new currency that the banking industry pays to buy this newly issued credit. The wholesale cost of newly issued debt-based currency, results in changes to the interest rates for loans, overdrafts and credit charged by commercial and retail trading banks.

The Reserve Bank calibrates New Zealand’s wholesale ‘cash rate’ to the overnight inter-bank lending rate to adjust the supply of scarce ‘settlement cash’ resulting in an easing or tightening of monetary conditions, in conjunction with a monetary policy tax on deposits to discourage banks holding too much cash. This monetary policy tax can be likened to a GST charge for hoarding too much fuel. The inter-bank lending that occurs between banks is rather like the settlements in oil, petrol and diesel stock levels that occurs between the fuel suppliers of New Zealand’s oil, petrol and diesel cartel. While there is competition at the retail level over prices marketed as interest rates, at the wholesale level there is systemic collusion because the banking oligopoly obscures the industry’s dirty secret; banks are credit manufacturers practising fraud.

In this way, the supply of credit shrinks or expands, and the fee for not withdrawing that supply — interest — fluctuates in price, thereby heating and cooling economic activity on the basis of the ‘loan’ approvals or declines, and their costs.

The nerdy data ‘just in’, reveals New Zealand’s unemployment rate increased to 4.80% in September 2024, up from 4.60% in June 2024, according to Trading Economics.

New Zealand’s Unemployment Rate is updated quarterly, available from March 1986 to September 2024, with an average rate of 5.50%, CEIC Data reported.

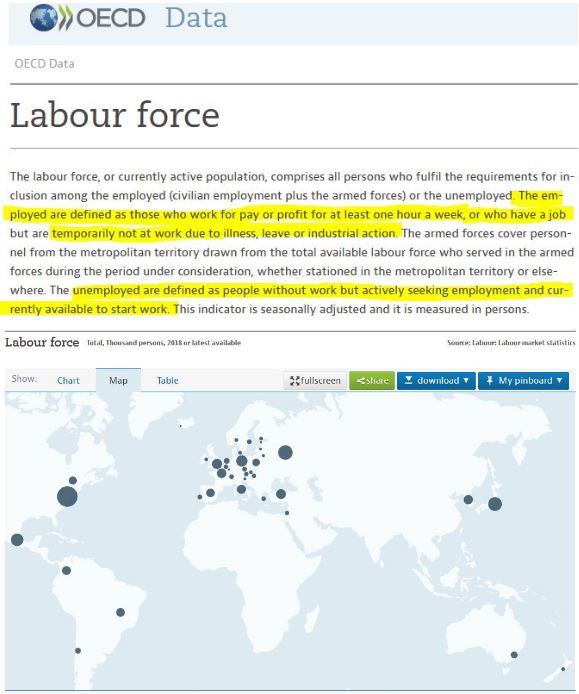

In the last quarter to June 30 2024, there were 148,000 counted as unemployed, while there were 2,341,000 full time employed, and 148,000 in part-time work. However, in 2014, the NZ Government adopted the OECD’s ‘one hour a week of work’ standard, that hides the precariousness of employment across the West’s global ‘super-economy’.

The annual inflation rate in New Zealand eased further to 2.2% in the September quarter of 2024, from 3.3% in the prior quarter, Trading Economics reported.

In 2023, New Zealand’s inflation rate was 5.73%, while in 2022 it was 7.17%, and in 2021 it was 3.94%, and in 2020 it was 1.71%, according to Macrotrends. This surge in inflation occurred due to several factors including oil prices spikes, supply chain disruptions, and massive state-led inflationary infusions of debt-based currency expansion, when the U.N.’s member nations inflicted Corona Curfews. In New Zealand, the Government maintained the injecticide and mask mandates longer than most jurisdictions, which compounded factors associated with the archipelago’s geographic isolation, including the Marsden Point Oil Refinery closure in April 2022.

With such Shock Doctrine policies, it’s a ‘no-brainer’ that New Zealanders will take flight, to find better opportunities overseas. As ABC reported, a release from Stats NZ said the year to March 2024 saw two annual recorded. More than 78,000 Kiwis left New Zealand. And for every one New Zealander returning home, three have left.

“This is the first time the annual net migration loss of New Zealand citizens has exceeded 50,000,” Stats NZ population indicators manager Tehseen Islam said. By July 10 2024, the NZ Herald reported Stats NZ data showed 85,600 Kiwi departures. The net migration figure kept getting worse. “Data released by Statistics NZ on Jan 23 2025, showed that 127,800 people left the Pacific nation in the year to November,” The Strait Times reported. “This is provisionally the highest number of people leaving in an annual period ever, according to the statistics bureau.” Therefore, on Lux Luthor’s watch, the drive to slash inflation by scuttling employment had driven almost 130,000 New Zealanders out of the plantation economy, to keep the bankers happy.

The capacity to scuttled jobs via inflation targetting is enabled by the Reserve Bank Act 1989. Governments saddled with debt-enslavement monetary systems all face the same predicament, known as the ‘policy trilemma’ — as Bryan and Rafferty outlined in their book, Capitalism with Derivatives (without pinpointing the debt-enslavement part).

In this scenario, governments cannot simultaneously pursue the following three broad policy agendas: (1) sustain the wealth that accrues to the workforce; (2) facilitate vast, fast international movements of capital; and (3) manage exchange rate stability.

Naturally, the technocratic elites in Treasury, the Reserve Bank, and the domestic and foreign think-tanks — served the will of super-wealthy international bankers — by prioritizing high international capital mobility and managing exchange rate stability.

Labour became the ‘swing mechanism’ of the ‘policy trilemma’ — like a pendulum.

When too much wealth accumulates among the workforce, the Overlords will inflict ‘discretionary idleness’ through ‘strategic sabotage of industry’. The cover-story of a pandemic was used to disguise this economic warfare inflicted at a global scale.

Because all human rights rest on the strength of one’s economic independence, and in turn the economic autonomy of one’s community, or society or nation, then it follows the overtitled Overlords cannot tolerate ‘too much’ wealth accruing to the peasants.

This is why a debt-enslavement system was inflicted in the colonial era during the New Zealand Masonic Revolutionary War 1860-1872, with the Bank of New Zealand being established by royal charter and legislation in 1861. The Bank of New Zealand brokered finance to escalate the ‘Maori Wars’ to consolidate the paper sovereignty swindled by a series of masonic imperial chess moves in 1839-1840. And it also why numerous wars were fought to impose a central bank on the United States, and other nations, as the broadcast All Wars are Bankers Wars, by Michael Rivero, makes clear.

This weaponization of employment is well known to economists, politicians and business reporters, who are all careful to ensure this callous system is sustained.

In Barry’s 2002 documentary, In a Land of Plenty – The Story of Unemployment in New Zealand former trade union economist Peter Harris said:

“The theory is that when unemployment is low, there’s always skill shortages and workers have the ability to demand higher wages, and to secure higher wages because the employers are competing amongst each other for scarce labour. And that pushes up costs and employers then recover those costs in terms of higher prices. And, so unemployment is quite a vicious, but effective way of dampening wage pressure and of, therefore, controlling prices.”

According to Trading Economics, New Zealand’s official unemployment rate had averaged six percent of the workforce from 1985 to 2014, and then it started to drop when the NZ Government adopted the OECD’s one hour a week standard.

The Organisation for Economic Co-operation and Development (OECD) standard of counting one hour of work a week as being employed is used throughout the world.

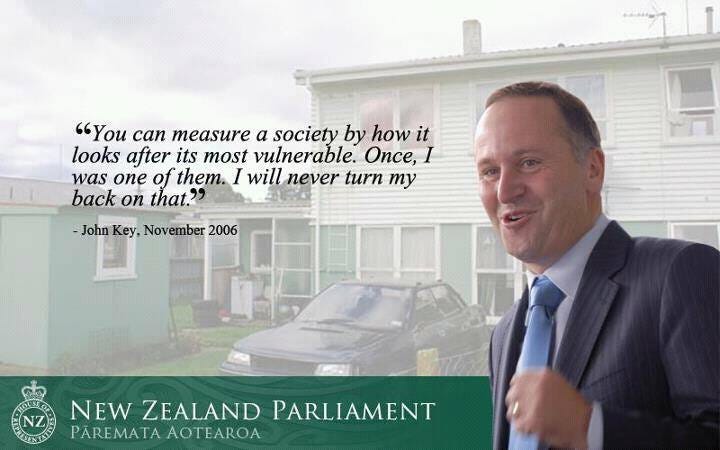

This low threshold allows governments to hide the true unemployment figures, and gets politicians, bankers and corporate lobby groups off the hook in maintaining structural unemployment as a hidden transmission mechanism for producing low wages and salaries. It was adopted by N.Z.’s Government on John Key’s watch.

This change in counting unemployment meant the true level of discretionary idleness that is maintained by the banking elite could be hidden from the headline unemployment rate. With this sleight of hand, the Civil Oligarchy would be rewarded with cheap credit for having achieved dominance over the Wellington Political Elite to achieve this vicious hidden mechanism to keep cost-side inflation rate down.

This regime was carried on by Jacinda Ardern, despite boasting boosted job rates.

In the Snoopman’s dispatch Discretionary Idleness: Structural Unemployment as a Shock Doctrine Economic Warfare Tool in Neo-Colonial New Zealand, he showed how the banking cartels’ collective control and influence over economic activity, and therefore political institutions, is exerted through interest rates, which is the fee that banks charge for continued supply of credit — the lifeblood of debt-based economies.

Through the use of charts, statistics and other cited documentary sources, the Snoopman demonstrated the relationship between the inflation rate, the wholesale interest rate and the control of cash and credit supply and how these economic indicators are actually manipulated to control the (un)employment rate.

The financial debt enslavement system requires ever more taxes to sustain the debt and the interest, because over time the expansion of the currency causes inflation, which reduces the purchasing power of the currency. The expansion of the currency occurs through mostly through the commercial and retail banking sector. The interest payments also produces pressure on prices to increase, and because this component is not created when the ‘loan’ principal is ‘borrowed into existence, there is also a dynamic of fierce competition to make money to pay the interest too.

Crucially, the super-wealthy and their transnational corporations, including banks, are able to minimize their tax exposure by exploiting trusts, domiciling in tax havens, and steering politics. This practice is termed oligarchic wealth defence.

Meanwhile, most mortal monkeys are indoctrinated to believe income tax is necessary to support government services such as education, hospitals and welfare, as well as infrastructure like roads, railways, bridges, ports, and energy plants.

However, income tax was only imposed during the 20th Century as wars were fought to subsume nation state autonomy, impose central banking, and draw nations into the Anglo-American Empire, which was forged to dominate via control of finance and oil.

Every empire needs an instrument of expansion, whether it be slaves, feudal knights, or oil. Empires require a strong military to wage expansionist wars and to sustain the gains in territories, treasures and technologies that feeds the intrument of expansion. An empire’s military power is dependent on the underlying economic dynanism.

Coalitions of oligarchs forge empires if left to their own devices for long enough.

Oligarchies can only exist in societies with extreme material inequality. As super-rich vampires, oligarchs thrive in crisis-ridden societies and they are the root cause of most crises, except natural ones. Some of the crises due to accident or incompetence, are ultimately caused by oligarchs because their unwieldy systems produce stupidity.

Yet, it’s possible to have societies finance public projects by printing debt-free cash, taxing imports and exports, to avoid enslavement via interest-bearing transactions.

But Why? Snoop-Splaining the Vicious Management of the Gap Between Poverty and Wealth

Snapshot: Despite changes in social indicator definitions, the New Zealand Government continues to maintain its 40 year-old hidden structural unemployment policy, to control inflation in order to sustain low interest rates for the rich.

Luxon’s Lieutenants have been performing these reflexive economic tricks because big business likes to maintain unemployment at around 6%, in order to weaken pay bargaining power of monkeys, who perform for wage and salary peanuts and chips.

Since employment costs are a major component of expenses in a company’s profit and loss statement — as every monkey-keeping accountant knows — high levels of employment drives up inflation, because wage and salary earning monkeys have more confidence to demand more nuts, crisps, and even spring water over fluoridated water.

In the documentary, In a Land of Plenty: The Story of Unemployment in New Zealand, trade union economist Peter Harris (1976-1999) explained the emphasis to control inflation, or rising costs, in order to protect the asset portfolio’s of the rich this way:

“I would see that stable prices is part of your regime for entrenching property rights. Because you can ascribe property rights, but if the value of that property is unstable, the rights themselves are unstable. So, price stability has to be seen as part of the policy agenda that is directed at defining and entrenching property rights and an exchange mechanism of those rights. That’s what we call ‘a market’.”

In a cruel world ruled by Mammon — where technocratic bankers oversee a debt enslavement monetary system — the key way to control the level of (un)employment is by indirectly setting the interest rates for loans, overdrafts or credit cards.

This trick is done by setting the rate of wholesale credit at the central banks, since it is this wholesale credit rate that represents the cost for trading banks to buy this currency. In turn, the banking industry will add their ‘mark-up’ margin, or interest rate, to produce a profit on the credit which bankers euphemistically call a ‘loan’.

The Reserve Bank wholesale lending rate, was measured by 30 day bank bill yields, until the Official Cash Rate (OCR) was introduced on March 17 1999. Indeed, the interest rates charged by trading banks (commercial banks and retail banks) for business ‘loans’ and overdrafts, home mortgages and car ‘loans’, and credit card debt, is the mechanism that creates the windfall in profits for the banking sector.

The dirty secret of the banking industry is that commercial banks and retail banks don’t actually loan any money they possess. At the time a ‘loan’ contract is signed by the ‘borrower’, the credit funds are actually borrowed into existence. This sleight of hand thereby renders the noun ‘loan’, as a euphemistic term to mask systemic fraud.

With such systemic credit conjuring, the banking industry operates as a racketeering cartel since they maintain a structural scarcity over the supply debt-free cash. This cash scarcity means households, businesses and government entities cannot earn enough debt-free ‘income’, to purchase a house, a building or a hospital, respectively.

The common understanding among mortal monkeys is that banks loan out the deposits of savers. This cover-story is a lie to hide the structural racketeering.

Banks use savers’ deposits to invest in company shares, corporate securities and government bonds. The margins of profit made from such investments, speculative bets, and derivatives gambling, actually pay for the bank’s operations such as monkey bank staff, monkey abacuses (computers) and the banks’ HQ and monkey branches.

* Former New Zealand PM and ex-Wall Street & London banker, and former ANZ Bank chairman, John Key, is depicted reading the Daily Prophet and carrying a ‘Money Tree Wand’, since he once sarcastically said there is “no magical fairy with a printing press at the end of the NZ garden” and that it was “a foreign pixie that we have to borrow from” to keep the economy ‘solvent’ while justifying selling off more tax-funded, state-owned assets. (Fairfax, 6 September 2012) As Prime Minister, John Key did not fully disclose the cartelized nature of New Zealand’s banking industry, its hidden mechanisms of debt bondage and the conspiracy between the NZ Crown, the Reserve Bank and transnational banks to entrap New Zealanders in a state of permanent financial enslavement.Meanwhile, the ‘deposit’ that mortagee monkeys stump up to qualify for a home ‘loan’ is not merely to prove a commitment to ‘pay back the loan’ and neither is it to supply proof of a track record of savings. Since the commitment to ‘repay the loan’ is in the ‘loan’ contract, which states that forfeiture of the house will occur if the ‘borrower’ defaults on the loan’, then the commitment is in signing the contract and being on the hook to payback the principal (total sum of the ‘loan’). Moreover, the act of stumping up a desposit, said to supply proof of a track record of saving, is a trick since the bank already either has such proof, or it accepts monies that originated from the mortagee monkeys’ family or friends. Furthermore, since the bank is simply conjuring credit, the purpose of the ‘loan deposit’ is to supply the cash funds to finance the credit creation.

On August 9 2023, Madison Reidy interviewed the then-Chairman of the ANZ Bank, who said the bank was requiring high loan to value ratio. Because there was high demand in the housing market during the Corona Crisis, Key said they were requiring a higher Loan to Value Ratio (LVR) than what the Reserve Bank was stipulating. The Reserve Bank set a threshold for home loans to be authorised at no lower than a 20% deposit for most ‘borrowers’, with a small band quailifying with less deposit levels.

The ANZ was cautious he said because once the inflow of New Zealanders dropped off, because other countries ease their corona controls before Ardern’s Goverment, the house market pressure subsided and house dropped. This meant borrowers could be negative equity if they borrowed more than the house was subsequently valued at.

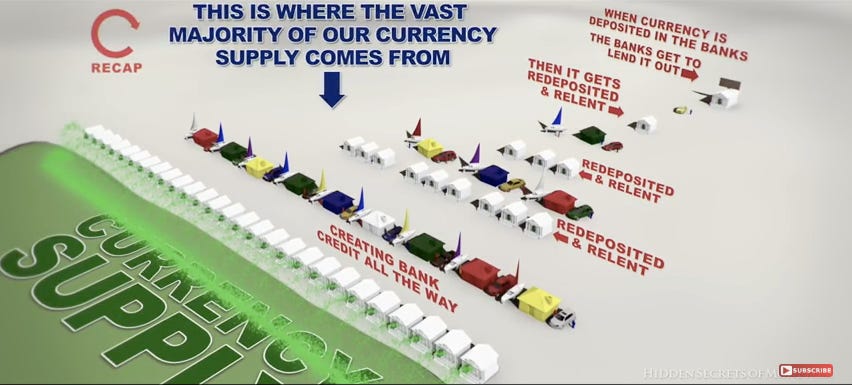

When new ‘loans’ are made, the manufactured credit funds are deposited into the cheque accounts of ‘borrowers’. Each time the proceeds from the sale of property are re-deposited, the banks have new funds that add to the deposit base to make new ‘loans’. In this way, the bank holds bank a fraction of the newly deposited as a ‘reserve’ with ‘one hand’, while with the other hand the banker uses this ‘cash’ to expand the credit supply by a magnitude, thereby creating an ever-expanding credit bubble.

Banks need only hold reserves that equate to a fraction of the actual deposit claims on their books in a fractional reserve banking system. This system creates financial bubbles.

In addition to earning profits off income-generating financial instruments, banks build up reserves by using some of the proceeds from the interest they charge for ‘loans’. In this way, interest is not “the price of money” — since no money that previously existed is lent. Rather, interest represents an extortionist rent on the amount of funds fraudulently marketed as ‘loans’. Ergo, banks manufacture credit.

It turns out that commercial bank credit manufacturing is the single major source of currency expansion in New Zealand, as Gillian Lawrence explained in a Reserve Bank bulletin in 2008, entitled “The Reserve Bank, private sector banks and the creation of money and credit”. Lawrence stated:

“By far the largest share of money – 80 percent or more, depending on the measure – is created by private sector institutions. For simplicity, we use ‘bank’ to refer to any institution that creates money or credit.”

Cash only constitutes about 1-3 per cent of the total, meaning the other 97-99 per cent is borrowed into existence as transaction specific credit.

Therefore, cash is kept scarce to coerce Tax Monkeys to ‘borrow’ manufactured credit funds into existence that, in turns, yields windfall interest for banks.

As Mack Ott of the privately owned St. Louis Federal Reserve pointed out in 1982, “Credit is not money, but the promise of future money to the lender in return for the current temporary use of purchasing power — goods or money — extended to the borrower”. Through their structural alignments, the world’s largely unseen dynastic bankers — through their transnational banking empires — ensure that actual cash is scarce. This scarcity compels families and businesses and governments to ‘borrow’ the bankers’ manufactured credit to build homes, enterprises or hospitals, respectively, and to compete for scarce cash to ‘repay’ the privately conjured credit.

In 2013, TVNZ’s current affairs-lite programme Seven Sharp aired a once-over lightly segment showing that most of the money in circulation came into existance as ‘loans’ by commercial and retail banks to borrowers. And, yet such borrowers are compelled to pay interest on this credit. Heather du Plessis-Allan interviewed a former London banker Raf Manji who advocated the government issue debt-free money to pay for needed projects. Banking reform campaigners from the Postive Money network point out 97% of the currency is created through ‘lending’ by private-owned foreign banks. And with ever-inflating property prices, future generations face living in debt.

Therefore, each generation are cast as ‘borrowers’ who are compelled to sell their homes and businesses at ever higher values just to break even because of the ‘rent’ banks charge for their manufactured credit, as English economist Michael Rowbotham stated in his book, The Grip of Death: A Study of Modern Money, Debt Slavery and Destructive Economics. Despite central banks’ ability to manufacture and obliterate “unlimited supplies of money and credit,” as former chairman of Federal Reserve Alan Greenspan put it, most credit is created by commercial banks through this ‘multiplier effect’ of ballooning credit bubbles. Therefore, debt-based currency systems are mechanisms of present and future social control, since the Global Tax Monkeys’ time, creativity and resources are wasted, as investor Mike Maloney states in his documentary series, The Biggest Scam in the History of Mankind.

The artificial scarcity of cash and abundance of privately manufactured credit, supports Crony Neo-Colonial Capitalism’s hidden purpose of making land scarce to as many Tax Monkeys as possible. In turn, Neo-Colonial Capitalism is the track-laying vehicle for the incremental implementation of Techno-Feudalism.

To sum up, in an nation afflicted with a debt-enslavement system and economic illteracy, Wellington’s Political Elite is able to mask the conspiracy to keep the nation saddled with the burden of debt, whether its mortages marketed fraudulently as home ‘loans’, student ‘loans’, car ‘loans’, business ‘loans’, overdrafts and credit card, or with income tax to service government ‘borrowing’. Currency expansion mostly happens through credit creation with home loans, business loans and credit card purchases.

The interest charges on home loans creates a pressure to sell such property at higher prices, to at least break even. Likewise, interest charges on business loans and overdrafts creates a pressure to make higher profits. Thus, interest on borrowed funds drives inflationary pressures. Government debt-funded spending also creates inflationary pressures, such as during the Corona Crisis. Inflation was the prize, as Australian medical doctor-turned singer, Iyah May, sang in her song “Karmageddon”, released as an ‘anthem’ for people who want “a better world, a peaceful world” free of “horrendous disgusting injustices”. While May cited inflation, her song didn’t reference how public and private sector banking elites maintain a scarcity over debt free cash, in order to coerce households, businesses and governments to ‘borrow’ at compounding interest. This coercion drives inflationary pressures, too.

The fast, brutal way to bring inflation down is to increase interest rates, which restricts new loans qualifications, reduces economic activity and scuttles employment.

Political Puberty as the Key to the Human Monkeys’ Emancipatory Evolution

Snapshot: New Zealanders need to grow a pair by developing parallel strructures to construct a parallel society that outsmarts the franchised totalitarian democracy, since oligarchies cannot be dismantled by democractic means.

New Zealand’s ruling Establishment treat the people of the geographically isolated South Pacific archipelago, with palpable disdain, like New Zealanders are trash.

Indeed, the population has been cast as monkeys who can be used as test subjects for an endless series of social engineering studies, technology tests and to trial political strategies, since its a small English speaking ‘cohort’ at the bottom of the world.

And because its a small isolated country, New Zealanders are submissive and reluctant to speak up, call out and whistle-blow. The Elite exploit this vulnerability.

Over time, the New Zealand Monkey has in effect become genus Homo small isle sapien retardus, since we are as a people easily governable. We are also getting screwed, daily.

Ergo, a ‘don’t rock the boat’ sentiment pervades the archipelago that the Snoopman considers a psychological disorder, which he terms Small Island Spectrum Syndrome Impairment (SISSI). Because it is endemic to New Zealand, a hyphen followed by an E may be added on the end of the acronym to render: SISSI-E.**

**Small Island Spectrum Syndrome Impairment (SISSI):

This small island cultural impairment shuns even moderate doses of critical thinking in social settings, workplaces, domestic environs and in political forums. Particularly, if the discourse is deemed ‘wrongthink’ because the ideas challenge the accepted problem framing, or the boundaries of discussion, or the desired solutions of the ‘in-group’ people. [Citation: Steve Snoopman]Yet, studies don’t show this mental disorder and neither that it is endemic to New Zealand, despite its traceable origins to the Victorian Era — perhaps because it is so embarrassing. Too many tow the line, and it is this code of silence that maintains the old boys’ network’s cartelized industries, as a closed shop. It outwardly appears competitive, but in reality is corrupt, controlled and criminally colluding with local and central government, as well as with a clique of non-profit private entities, billionaire-funded foundations and supranational governance institutions.

Because everyone is etching out a living on a small island archipelago, the small-minded nit-picking is a constant feature of New Zealand life, against a backdrop of bigger issues for grown-ups to problem solve. The situation behooves evolution.

This cerebral impairment, I contend, makes N.Z.ers susceptible as a people to remain divided, deluded and dispirited. Our continued ignorance of its pervasiveness in our cultural psyche, means we are vulnerable to continuing exploitation as test subjects, since this remote, developed English-speaking small population is an ideal laboratory.

The ocean-moated South Pacific archipelago has long been used as the world’s premiere test facility for new technologies, political strategies and social engineering. ‘New Zealand has more pilot studies than pilots’, a retired joke claimed.

The country is practically run in accordance to political strategies, policy frameworks, and technocratic tactics shaped in unseen processes by political strategists, polling companies, think-tanks, law-firms and accountancy agencies, ratings agencies and P.R. agents. This test facility casting essentially positions New Zealand in a parallel universe-cum-redux version of Ground Hog Day. Except, New Zealanders don’t get to restart the day over until they win over their desired love interest.

Instead, we are recast as ‘Carrot Landers’, who are expected to behave like cheerful bright orange bags of export-quality carrots — unblemished, perfectly formed and too polite to challenge the toxic regime. And we pay high prices for locally produced goods, becuase we are a captive market, who in effect pay for the logistics of exports.

Kiwis are marketed like tourism industry extras. This outward cheerfulness is what Gordon McLauchlan was alluding to in 1976, when he described Kiwis as passionless, conformist, anti-intellectual zombies, while there was an underlying toxicity such as racism toward Pacific Islanders for ‘overstaying’ their stint as migrant workers.

Much has changed since. People are more open-mined. Yet, there persists a zoned-out attitude that venerates blissful ignorance likes it’s a virtue. But, it endangers us all.

New Zealand’s perennial role as a location to field-test political strategies, social engineering pilot studies and technology innovations has not simply been predicated on the idea that the guinea pigs will not find out they are test subjects — as the Bilderberg Group mouthpiece magazine, The Economist, reported in 2015. The assumption in-built into the experiments is that the South Pacific test-lab’s isolated location affords the experimenters the capacity to shutdown any contagion of truth from spreading around the world — should an experiment go badly wrong, or if its dark secrets are decoded. Carrot Land’s international airports are no Heathrow.

Given the foregoing, Snoopman wondered how different the world would be if humans of Earth weren’t simply educated to be just smart enough to become plumbers, plasterers, painters, porters, package handlers, police officers, parole officers, peace officers, payroll clerks, pianists, photographers, painters, pilots, pathologists, pharmacists, physicians, physicists, politicians, and professors.

Because — the present trajectory of debt-enslavement is an extinction-bound evolutionary branch of homo retardus that is an existential threat to ‘human monkeys’.

We don’t have to remain as Homo small isle sapien retardus. We can embark on a journey of political puberty — without needing to obtain anyone’s permission.

By finding the inner resolve to participate in the emancipatory evolution of the human monkey. The trick is to discover or recover our innate gifts, talents and develop our skills to become border-line super-heroes who strive to be the best versions of ourselves. The ultimate mischief is to undermine the evil plots of the Overlords.

The human monkeys of Earth — a far-flung planet that lacks adult supervision — have been conditioned to submit to hierarchical power structures that maintain Overlords’ over-entitled lives. Yet, we are the ones who do the work, have the skills and even the bright ideas, that can be harnessed to forge parallel societies.

The brutal truth is New Zealand’s modern oligarchy was forged in a dozen years when the nation was mangled in a planned heist of the economy. Despite Luxon making the headline claim, ‘the wealthy aren’t the problem’, the famous MIT scholar Noam Chomsky observed more generally in the 2015 documentary, Requiem for an American Dream, the “concentration of wealth yields a concentration of political power”.

Like other political lawmakers, Luxon’s financial and asset disclosures to parliament provide a modicum of detail. Digging by journalists has revealed Luxon’s properties — a family home in Remuera, a Waiheke Island bach, an apartment in Wellington, his electoral office and three investment properties in Onehunga — have a combined value of $21.145 million. Luxon’s Remuera home was valued at $7.68 million in 2022.

The current value of his Waiheke bach is $7.36 million. His apartment in the capital is valued at $1.07 million. Luxon’s statutory disclosure in 2021 reveal four beneficial interests in, and trusteeships of the Rae Family Trust (trustee). However, this trust does not appear in the 2022 and 2023 disclosures, while he presently has four retirement schemes and deposits with the ANZ Bank. In 2019, he was Air NZ’s 18th biggest stockholder in the airline, with more than $12 million worth of shares.

Ergo, with properties valued at $37 million, and with accounts of undisclosed value, Luxon may be close to, or above, the $50 million threshold of the NBR Rich-List.

As I showed in part 1 of my first Lux Luthor series entitled, “Operation Overwealth”, a highly-networked global élite stealthily pimps out planetary policies, while mass populaces, including New Zealnders, are lined up like ducks for vote harvesting.

Oligarchic power cannot be dismantled by democratic processes nor by its insitutions, as Jeffrey Winters stated in his seminal 2011 book, Oligarchy.

Economic wealth is transformed into political power. Broadly, the condition for allowing representative or limited democracy is that the democratic society does not bother the oligarchy. As Bertrand De Jouvenel warned in On Power in 1945, where-ever totalitarian democracy is franchised, the people have little to counter its force.

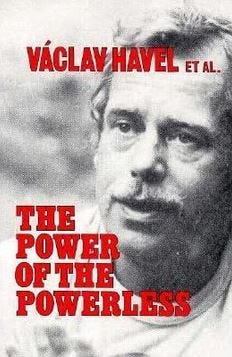

Dissident Václav Havel wrote that ‘parallel structures’ emerged to forge social self-organization to cope and rid itself of draconian control amid totalitarian regimes. The people had taken on the ideas of Ivan Jirous, who expressed in “Parallel Polis: An Inquiry”, who argued the only alternative indepenedent parallel society composed of parallel structures that run autonomously, so numerous, as the only dignified solution.

In his 1978 essay, “The Power of the Powerless Citizens Against the State in Central-Eastern Europe”, Havel observed that such parallel structures as businesses, institutions, groups, technologies or creative pursuits groups that existed morally outside the totalitarian regime were more effective at combating totalitarianism than direct political action. Havel — who later became the 1st President of the Czech Republic — also stated that when enough parallel structures form, a parallel culture or society spontaneously forms as enclaves of sanity within the totalitarian regime.

Therefore, we, the New Zealand Monkeys, can ‘flip the switch’ on the South Pacific archipelago’s role as a test lab for the ‘developed world’, to trail-blaze self-autonomy.

See also: 13 in the Numbers of Chris Luxon’s Career Path in part 2 of Lux Luthor’s Secret Worship of Mammon at The Snoopman Files.

Back when Steve Snoopman was ‘Snoopboy’, he delivered the Auckland Star during the dark days of the Reagan White House. Later he forged his superpower to ‘Thunk Evil Without Being Evil’ while writing a thesis on the Global Financial Crisis. Upon quipping that Batman failed to bust any Gotham banker balls — since his bat-ass is owned by DC Comics — he consequently realised New Zealand needed a Snoopman.

Editor’s Note: If we have made any errors, please contact Steve ‘Snoopman’ Edwards with your counter-evidence. e: steveedwards108[at]protonmail.com

Steve Snoopman also posts on Snoopman News [at] https://snoopman.net.nz/

See also: “Lux Luthor — Part 1: Operation Overwealth” at The Snoopman Files.