Lux Luthor — Part 2: High Flyers Club

Down the New Zealand Knights of the Round Table Rabbit Hole

In part 1, “Operation Overwealth”, the career trajectory of former Air New Zealand CEO Chris Luxon was examined in parallel with tectonic geo-political shifts over the course of the last half century, corresponding with Luxon’s life-span. Scholarly sources were presented to show that oligarchs can only exist in societies with great economic inequality. But also, that the super-rich use their immense wealth to steer the political trajectories of whole societies, while thriving in crises.

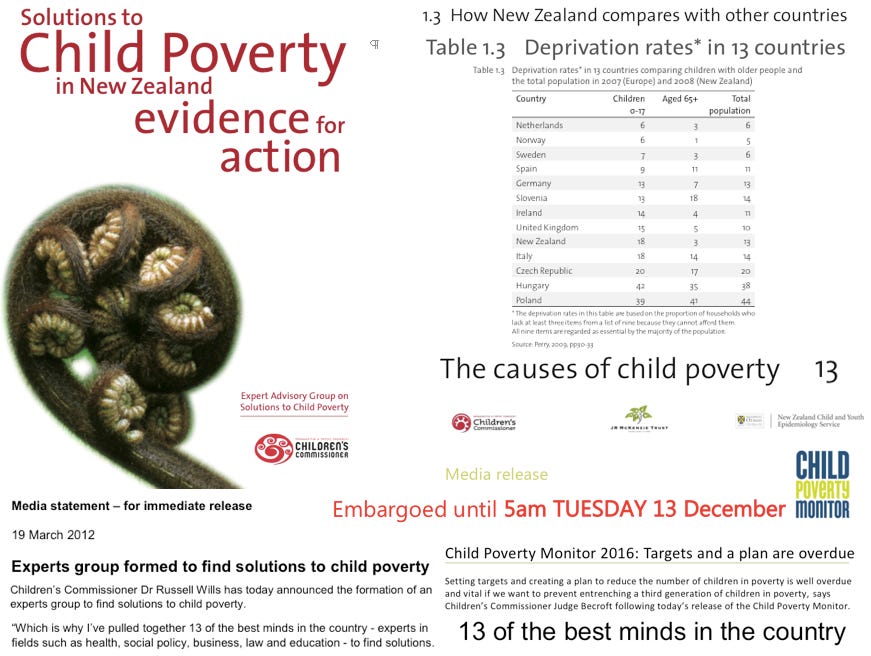

In this part, former Māori Television editor, Steve ‘Snoopman’ Edwards, demonstrates how New Zealand was reset in the mid-1980s to reforge the nation as a crisis-ridden society for benefit of a civil oligarchy. The archipelago was re-engineered from a centrally-planned inefficient economy controlled by Wellington bureaucrats, into a tollbooth economy centrally-planned by Big Finance, Big Agencies, and Big Think-Tanks — delivering financial impoverishment for most.

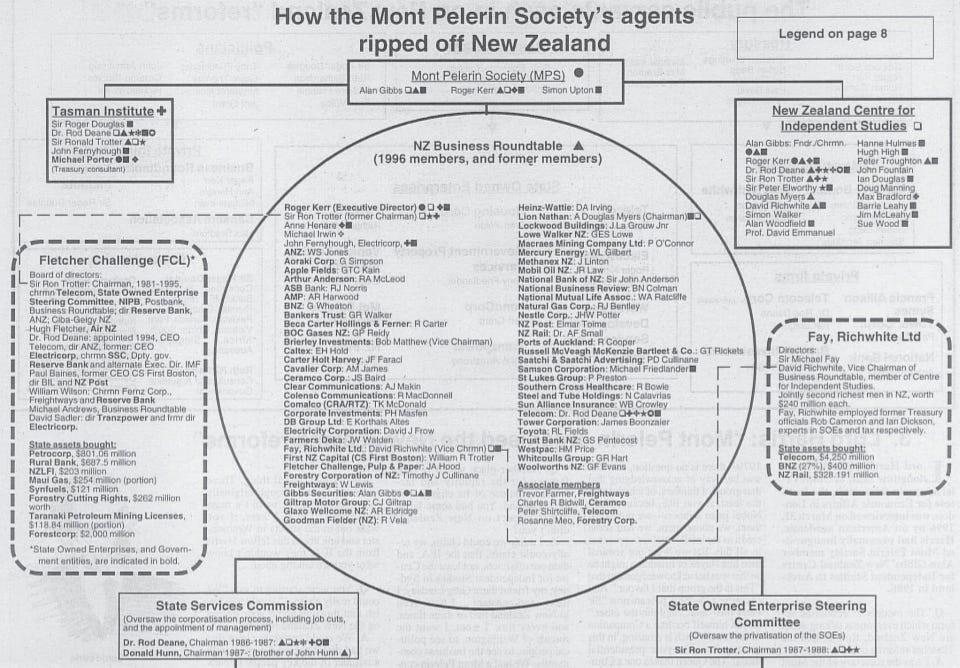

As he noted in part 1, Luxon’s participation in a business delegation to Switzerland in 2017, was sponsored by the New Zealand Initiative. In 2012, this think tank was incorporated as the result of a merger between the New Zealand Institute and the New Zealand Business Roundtable. The Business Roundtable was the most notorious of the domestic think-tanks that colluded to privatize state assets, while its members inflicted economic warfare to impoverish the population in cahoots with state managers at the Reserve Bank, which was established by statute in 1933.

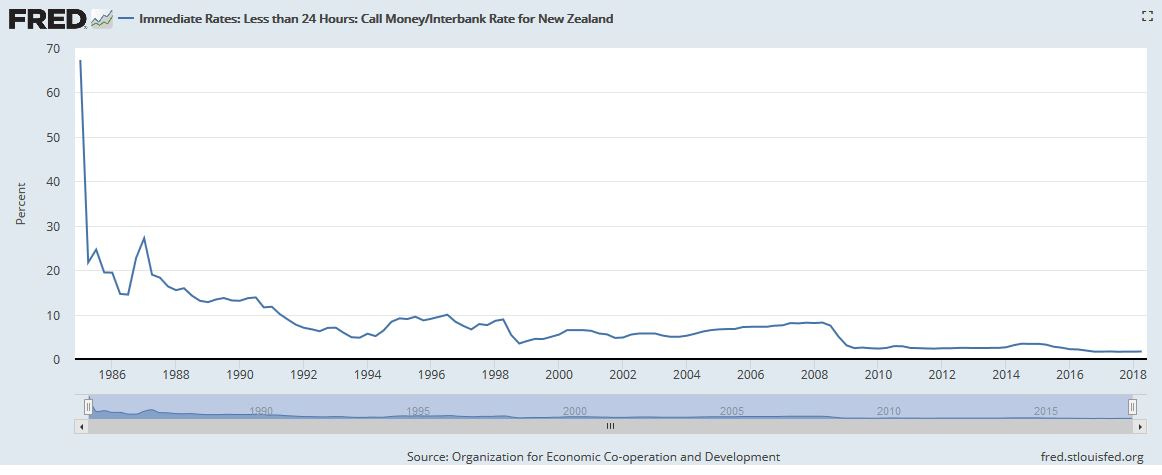

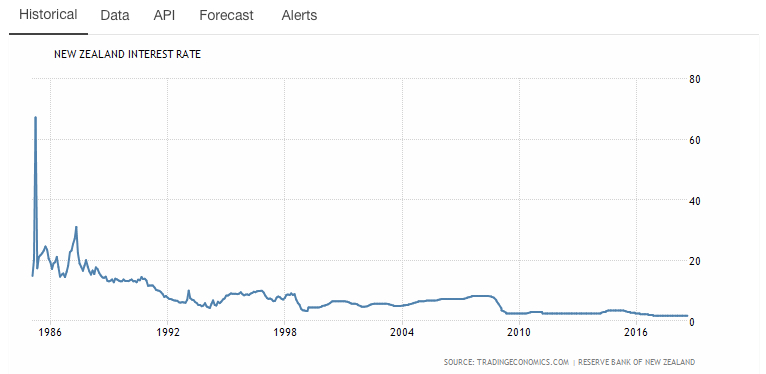

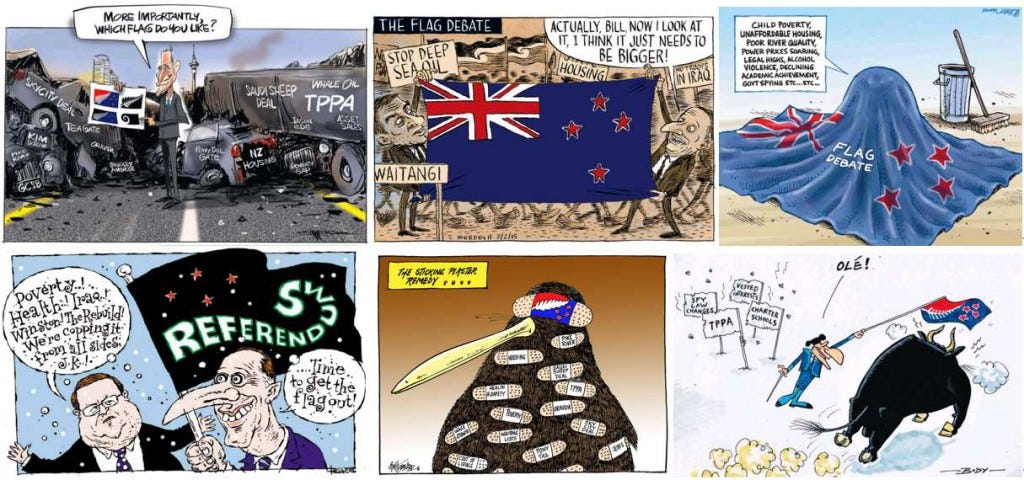

This High Flyers Club exposé also proves how the Reserve Bank, in collusion with Treasury and with the domestic and international banking cartel — only let interest rates fall through thresholds once state managers had inflicted desired policies, or once such measures had the intended results and would (or had) cause(d) the inflation rate to drop toward a desired margin. On Don Brash’s watch as the Reserve Bank Governor for 13 years and 33 weeks, he oversaw this inflation targetting regime; a scheme to suppress wages and salaries to deliver big businesses big profits.

This deep dive shows why the nation is an expensive place to live. Snoopman traces the sell-off of state commercial trading entities, infrastructure and services to local and foreign corporations, to demonstrate these wealth transfers transformed Kiwis into neo-feudal peasants — eternally paying taxes, tolls, and tickets to oligarchs.

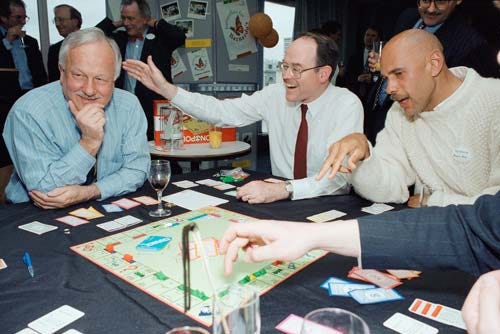

Kiwis are shown to be cast like hapless players in a New Zealand Edition of Monopoly, where the game is periodically updated by the game’s ‘owners’, to suit the wealthy players, particularly ‘the banker’. Ergo, economic impoverishment is key to undermining all rights, including freedom of speech, association and movement.

Therefore, part 2 “High Flyers Club” of this six-part series, Lux Luthor Redux, climbs far above the clouds to metaphorically cruise at 33,000 feet over the South Pacific archipelago to show Luxon has benefited from the Halcyon Days of the Heist of New Zealand Monopoly Board, when the oligarchy reforged itself and grew richer.

Central Planning Shifts from Government to Central Bank & Associates

For the best part of two decades, a corporate-activist lobby ‘club’ turned free-market think-tank was at the epicenter of a heist of the economy. This group, the New Zealand Business Roundtable — was comprised of big business leaders — who colluded and conspired with public officials to orchestrate a capture of state assets.

Some of the Business Roundtable’s members doubled as government officials, while leading huge corporations, and with such insider knowledge bought stocks, merged companies, and sold off state commercial trading entities — while changing the rules of the ‘Monopoly board game’ to benefit themselves, their cronies and foreign buyers.

Among those assets the Business Roundtable coveted, were industrial plants built, paid for, and maintained by Kiwis, from the end of the first decade of the ‘Cold War’.

A concerted effort to re-industrialise New Zealand occurred on Labour’s watch between 1957 and 1960, and continued with National — as Bruce Jesson recounted in his 1987 book, Behind the Mirror Glass. The Minister of Industries and Commerce, Phil Holloway and the Secretary, Dr Bill Sutch, signed eleven secret agreements with overseas companies to establish industries in NZ. These included the Marsden Point Oil Refinery, New Zealand Steel, and Comalco Aluminium Smelter at Tiwai Point.

Thus, the ‘New Zealand Edition’ of Monopoly was re-configured with a mix of state-ownership, local oligarchs and foreign investors. The projects received state funding, land grants and tax breaks, and grew NZ’s oligarchy, since this industrial development created monopolies, Jesson observed. And, the debt-based monetary system continued.

The gaming of New Zealand advanced on Robert Muldoon’s watch as Prime Minister (1975-1984), when large industrial development ‘loans’, liberalizing regulatory controls over the share market, and legislating voluntary union membership happened.

In the mid-to-late 1960s, the impetus for a re-set of the New Zealand economy and the rest of the world came from the then-North Atlantic Capitalist Class, who faced several major crises. These ‘calamities’ were: a structural crisis of Declining Profit Rates for transnational and state-located corporations; a Crisis of Democracy presented by the numerous 1960s Peoples’ Movements; and demands from a Developmentalist Movement in the ‘Third’-and-‘Second World’ countries for Western technologies in fair return for the resources supplied to rebuild Western Europe and Japan following WWII. Since the Bretton Woods Agreement of 1944, America and its currency had been the keystone, requiring each country to maintain the exchange rate of its currency within 1% of a specified value of gold, convertible at US$35 an ounce.

The validity of the ‘American dollar’ as the world’s defacto currency had come into question amid huge deficits run-up during America’s War on Indochina.

The common understanding is that it was Nixon — with his announcement, which interrupted NBC’s 9pm broadcast of Bonanza, on August 15 1971 — who had decided to remove the United States dollar’s convertibility from a stable value of gold, or the ‘gold standard’. By removing gold as a stable standard against which commodity and currency values had been measured, commodities once again entered the ‘casino circuit’ for speculation-driven inflation that had occurred prior to the engineered Share-Market Crash of 1929. In 1971, American dollars in the international arena became a fully fiat currency, which is paper money with no precious metal backing.

Matters came to a head in early August 1971 when former Rothschild banker and French President George Pompidou (1969-1974), who was also a Knight of Malta, sent a battleship into New York Harbor to remove France’s gold from the vault of the New York Federal Reserve Bank and to transport it to the Banque de France in Paris.

The North Atlantic banker dynasties that owned the Federal Reserve banking cartel needed to re-invigorate the US FED dollar, which is backed by the U.S. military.

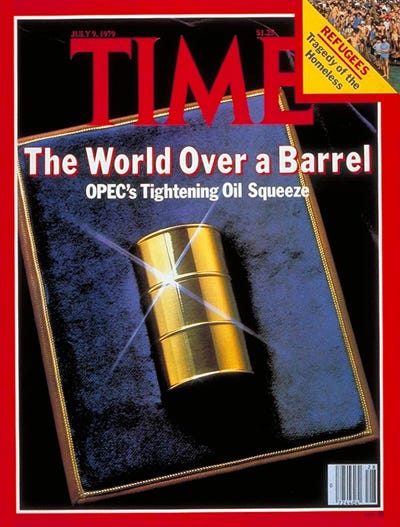

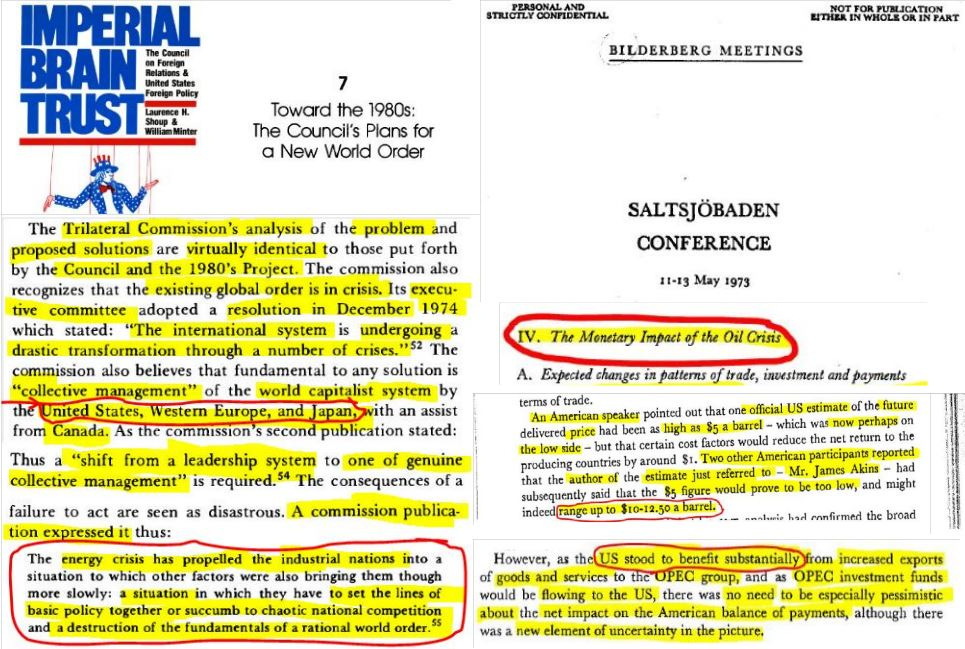

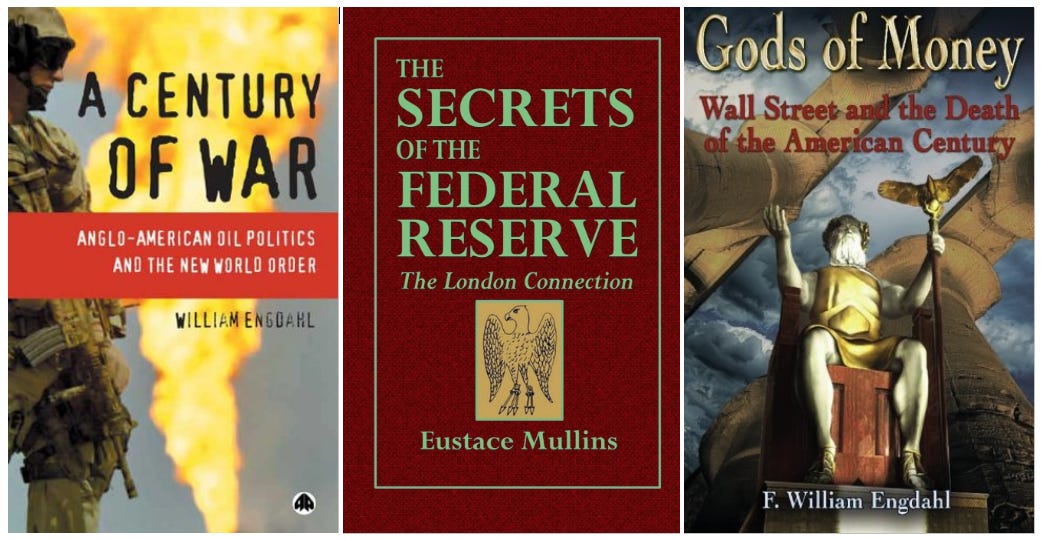

To this end, the Yom Kippur War of October 1973 was triggered by a ‘Rockefeller-Kissinger-Bilderberger Nexus’ to reset oil prices to reforge the US FED cartel with a Petro-dollar, gaslight vassal states to buy US weapons and weaken governments with a world debt crisis, as William Engdahl’s A Century of War and Gods of Money reveal.

Kissinger orchestrated the Yom Kippur War by deceiving the Egyptians, Syrians and Israeli’s about one others’ agendas, knowing the Arab states of 13 OPEC cartel would inflict an oil embargo in retaliation for the US supporting Israel in the war.

Amid the apparent oil scarcity, the world was forced to pay 400% more for petroleum, which was traded in U.S. dollars. Conspicuously, the Shah of Iran ‘boycotted the boycott’ and increased oil output to the U.S. and British ports to counter the ‘scarcity’.

The Oil Price Shocks laid the groundwork for subsequent ‘free market economic shock therapies’, or structural adjustments, since many weakened governments resorted to IMF loans amid ‘stagflation’, or stagnated economies with high inflation.

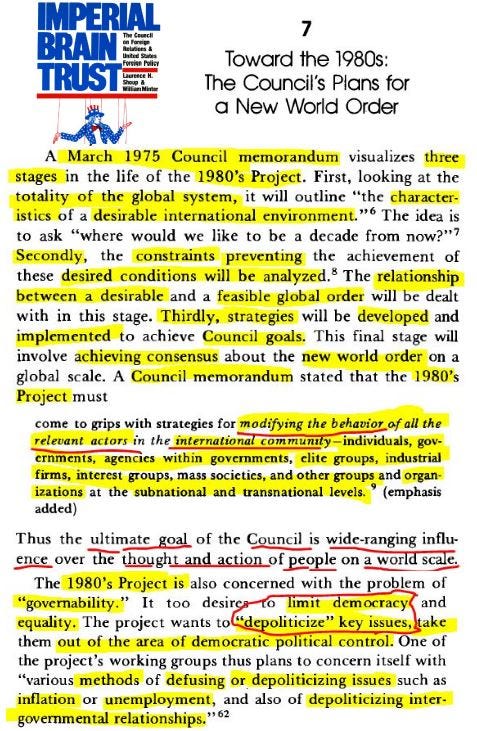

A New York-headquartered think-tank, the Council on Foreign Relations, chaired by David Rockefeller (1970-1985), developed a blueprint, dubbed the ‘1980s Project’, for reasserting the dominance of the American Oligarchy over the world with market economies. The 1973-74 Oil Shock meant that Wall Street banks, and most especially Rockefeller’s Chase Manhattan Bank, made enormous profits from ‘Petro-Dollars’.

When Muldoon became prime minister in 1975, he appointed Bernie Galvin as Permanent Head of the Prime Minister’s Department, on secondment from Treasury, to lead a liaison group that would glean economic intelligence from around NZ.

By this time, Bill Sutch had been accused of being a Soviet spy by the NZSIS, and despite being in retirement, was arrested after Prime Minister Norman Kirk had died suddenly. Sutch was humiliated in a farcical one day trial, but acquitted by the jury.

Muldoon appeared to believe the SIS’s official view on Sutch. The Sutch Affair appears to have been theater between factions locked in a fight to carve up the public state.

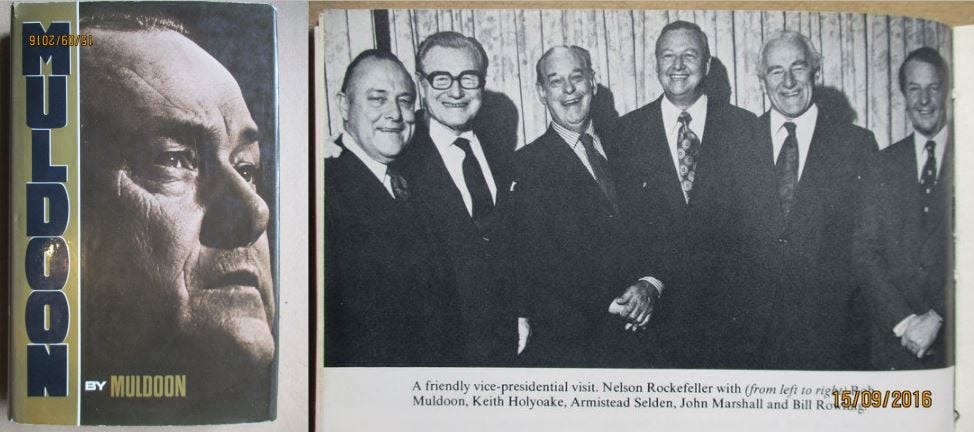

Curiously, Muldoon acknowledged Sutch was a “driving force” behind the Industrial Development Conferences. In his sanitized biography, Made in New Zealand: The Story of Jim Fletcher, Selwyn Parker mentions the old Sir James Fletcher attended these San Francisco conferences, that comprised 500 of the planet’s leading industrialists, bankers and feudalists from the very first one in 1957 and by 1969, his son Jim was on the policy board. The Fletcher Dynasty’s founder, Sir James Fletcher I (1886-1974) and his son Sir James Muir Cameron (‘Jim’ or ‘JC Junior’) Fletcher II (1914-2007), both used to rub shoulders with the Rockefeller Dynasty’s leading patriarch, David Rockefeller, as well as Marcus Wallenberg of the Swedish banking dynasty, and Giovanni Agnelli at the élite invitation-only International Industrial Conferences. All three oligarchs were regular attendees of the annual Bilderberg Foundation confabs, which was founded by former Nazi SS Officer, Prince Bernhard, a German royal, who married into the Dutch Royal Family. For their part, Rockefeller’s Standard Oil re-registered its oil tankers with Panama, a neutral country during World War II, to evade the British Blockade, meaning the oil dynasty could supply the Nazi Empire with fuel.

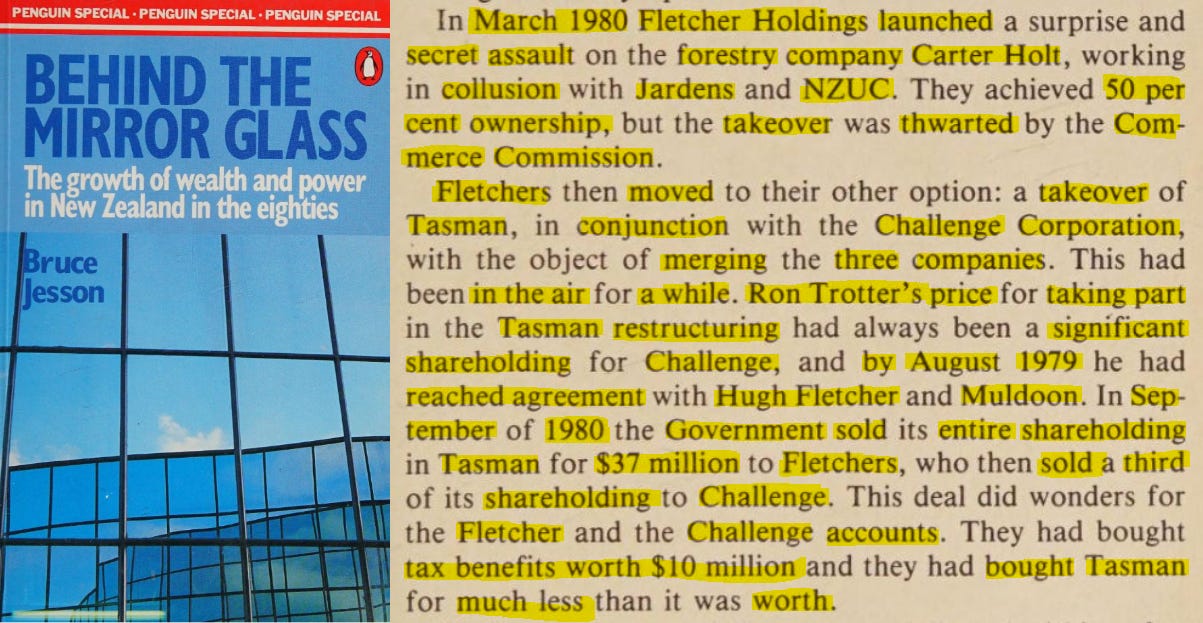

The theater seemed to continue in the spring of 1977 when Muldoon’s Ministry appeared to put Tasman Pulp & Paper in play; in commercial parlance, offering it for sale. James Fletcher had approached Muldoon for a credit line to support Tasman, which was locked into a 15-year supply contract with its newspaper clients, that contained an onerous inflation clause set to expire in 1983. (This error is curious given that Fletcher was connected to the major Western industrialists). Moreover, Tasman had an ‘unwieldy’ board structure comprising the NZ Crown, New Zealanders, Australians, and British, as investors. Secretly, Muldoon directed Associate Finance Minister Hugh Templeton, to speak with Reginald Smythe, head of NZ Fortest Products; John Spencer head of Caxton Pulp & Paper; and Richard Carter, head of Carter Holt and with the head of Winstone — all without Mr Fletcher’s knowledge.

Despite this brinkmanship, Fletcher, Smythe and the Muldoon Government agreed the board and ownership structure ‘needed’ to change. The Government selected Ron Trotter to be the new chairman of Tasman, while James (JC) Fletcher II was granted a symbolic position of president, to save face that he was being retired. In September 1980, the Crown sold its share of a revitalized profit-making Tasman, after Trotter had gained an agreement with Hugh Fletcher and Muldoon by August 1979. Fletchers bought 81 percent of Tasman and sold a third to Trotter’s Challenge Corporation. According to Parker, Trotter claimed credit for persuading Muldoon to sell the Crown’s stake. The takeover was part of plan to merge Fletcher and Challenge.

Templeton recalled the second Oil Price Shocks in 1978-1979, triggered by the Iranian Revolution caused a “major re-think” in Wellington. The Iranian Revolution — that saw overthrow of Shah Mohammad Reza Pahlavi’s monarchical government and the installation of the theocratic government of Ayatollah Ruhollah Khomeini — was a form of ‘blowback’, a CIA term for the unintended consequences to machinations.

In 1980, when James Fletcher II was knighted, he was flattered with telegrams, letters and phone calls from lords, baronets, knights and governor-generals from Australia to England, blue chip City of London bankers, Bechtel, Japanese captains of industry, and Evelyn de Rothschild, of the cousin-hood-breeding Rothschild banking dynasty.

By stepping aside for Ron Trotter, James Fletcher II acted as a ‘gracious’ exemplar to signal New Zealand’s economy was a test-bed for a global trend: a merger wave.

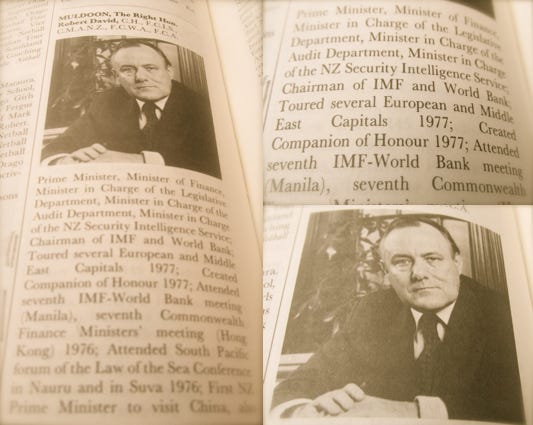

Meanwhile, in 1979 and 1980, NZ’s Prime Minister, Robert Muldoon, led a virtual double-life as chairman of the International Monetary Fund and the World Bank board of governors. These top banking positions placed him in a position to ‘borrow’, and, in effect, symbolically signalled NZ was about to become the First World’s pre-eminent Shock Therapy test lab. With these co-governance arrangements, Kiwis would be on the hook to repay credit lines that funded ‘Think Big’ infrastructure.

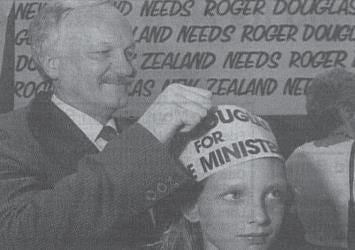

To prepare the way for the infliction of a corporate heist of the economy, an economics professor from the Rockefeller founded-University of Chicago, Milton Friedman, was invited to visit New Zealand in 1981, by Don Brash (and one other).

Friedman taught his students, dubbed the ‘Chicago Boys’, how to inflict economic warfare and emphasized a concept of ‘speed, suddenness and scope’. His ‘Chicago Boys’, were among the many economic missionaries who spread ‘free market’ shock policies around the world. These economic shock therapies were field-tested on countries such as: Brazil in 1963, Indonesia in 1965, Chile and Uruguay in 1973 and Argentina 1976 using US-backed military violence to destroy the Developmentalist Movement, as Klein described in her book (and later reworked as a documentary).

This co-founder of the Anglo-Swiss Neo-Feudal Mont Pèlerin Society received such favourable press when he visited New Zealand in 1981, it might be fair to say that journalistic submission preceded regularity capture. In other words, the capitulation of the Wellington’s Political Élite, meant they became Regulation-Lite turn-coats working in service to the Neo-Feudal capitalist coalition. Their flipping followed the fawnification of the political and business press, who were turned as easy as family pizzas at Pizza Hutt franchises. Friedman’s charm offensive weaponized the press.

In June 1982, Muldoon instituted a policy shock when he froze rents, interest and prices amid galloping inflation and an impassé with trade unions on wage bargaining.

Conspicuously, everything was frozen except the share-market, which boomed.

Muldoon was stuck between an oligarchic rock and a hard labour place. Proponents of a market economy, which was a sanitized term to describe technocratic neo-feudalism (later dubbed neoliberalism), had tried to persuade Muldoon. But what they proposed was full-blown economic warfare that would upend businesses, including farms, as well as privatize state trading entities and cause hardship. And, the labour unions would not give any ground on demands for wage and salary increases to keep pace with high inflation — as a result of crises ultimately caused by the planet’s Overlords.

Meanwhile, property investor Bob Jones spearheaded the now-defunct New Zealand Party (1983-85) in order to split the vote, so that the Labour Party would win the general election in 1984 over the incumbent National Party. Mr Jones evidently hated Muldoon’s ‘price freeze’ because it worked as a ‘rent ceiling’. The Knights moved.

Jones’s move was ironic because he had established the Capital Club in the mid-1970s as a political fund-raising mechanism to propel the National Party and his friend Robert Muldoon into power in 1975, to pass the Property Speculation Tax Repeal Bill.

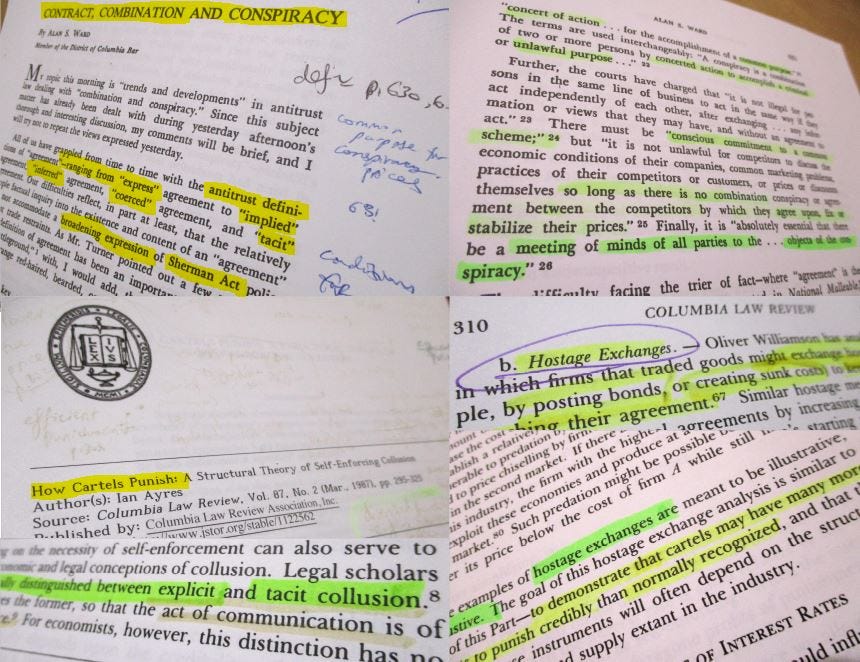

Thus, it seems counter moves to Muldoon’s instincts to prevent the Neo-Feudal Sect from taking over the economy, resulted in a theater detectable in the meta-data and performed as ‘Hostage Exchanges’ to signal ‘cooperation’ — as game theory predicts.

In their paper, “Resolving social conflicts through hostage posting: theoretical and empirical considerations,” Gideon Keren and Werner Raub noted that “tacit communications of threats and promises are two major message strategies used to influence the behaviours of others”. Elites signal their synchronized moves by posting themselves as ‘hostages’, such as with public announcements, and codified for instance with the number 13 to communicate solidarity, caution, and who to scapegoat if a scandal breaks. Colluding players are compelled to perform Hostage Exchanges — lest punishments are inflicted for defections on subsequent moves.

Game theory strategies such as ‘Hostage Exchanges’ are used by nation states, international syndicates and monopolistic cartels to stabilize power structures while aggressive rivals seek to construct new areas of market dominance by illegal, fraudulent and repugnant means that harm their more dynamic, innovative smaller and peaceful competitors. America’s development of game theory occurred during the Cold War to stabilize the power structures of the Russian Empire and the American Empire by mitigating the chances that the world’s two superpowers would engage in nuclear war. Subsequently, game theory migrated to the corporate world.

Thus, in June 1984, when the National government narrowly defeated a Nuclear Free New Zealand Bill that had been sponsored by Labour Party MP, Richard Prebble, most New Zealanders did not realize that a political-financial coup was underway. This politically shrewd introduction of the Nuclear Free New Zealand Bill had caused Muldoon to gain votes from two renegade Labour MPs, because two National MPs, Marilyn Waring and Mike Minogue, voted with the Opposition. On the night of June 14th 1984, an embattled, embittered and spirits-fuelled Muldoon called a snap election; in spite of warnings that such an event amid an imposed freeze on prices, wages, interest rates, dividends and the exchange rate — would likely trigger a currency attack. It did, immediately. The spectacle of crisis was manufactured.

Earlier, in May 1984, the Labour Party Executive has released its international affairs policy platform stating its intention to legislate to make New Zealand nuclear-free and ban visits by nuclear-armed or powered vessels. Meanwhile, the Labour Party had suppressed its economic policy proposals to transform the nation into a market economy. The circumstances in which Lange and other Labour Party politicians just happened to be having dinner with the Governor-General, Sir David Beattie, and the Parliamentary Press Corp, at Government House, on that June 14th night, have never been fully disclosed by key players — including the head of the Prime Minister’s Department, Gerald Hensley — in light of the broader state-craft occurring.

The evening that Muldoon stated July 14th was “the appropriate date” for the election, he added “we’ve worked it out at Government House.” When the embattled Muldoon visited Government House to confer with the Governor General, Sir David Beattie, about an election date, he was keep waiting and became sloshed on gin.

Evidently, the Governor General ‘decided’ on Bastille Day, of French Revolution fame.

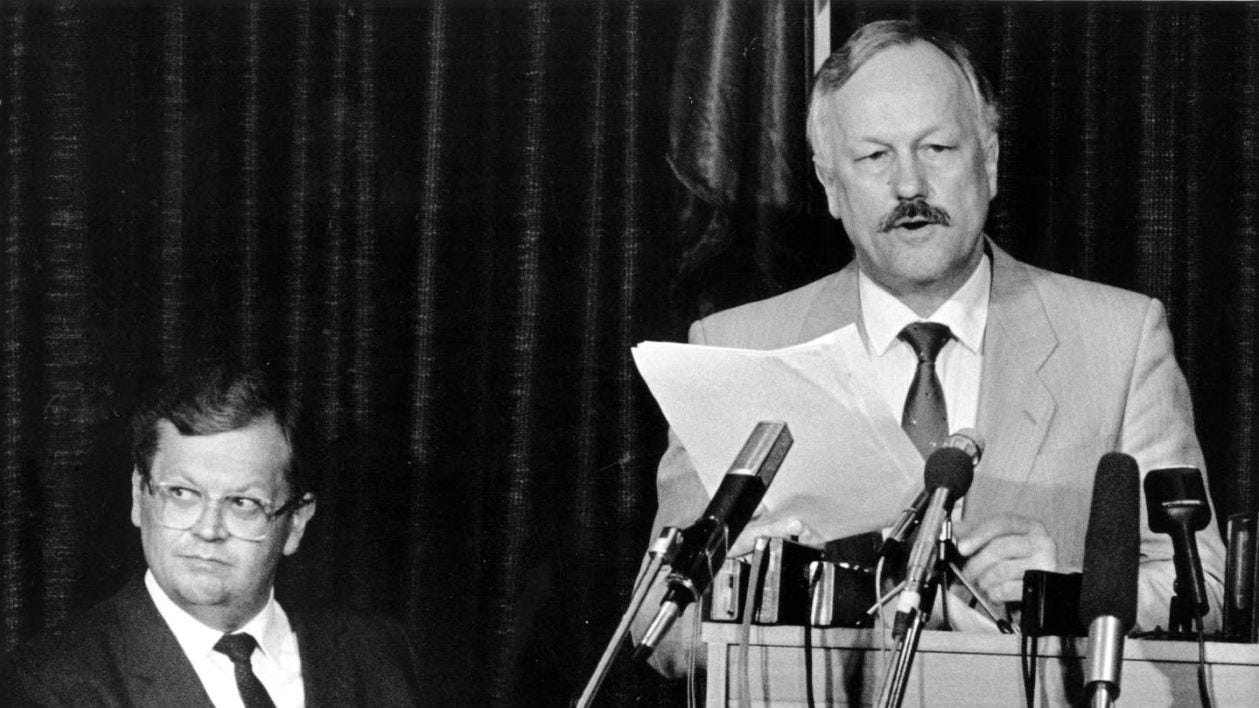

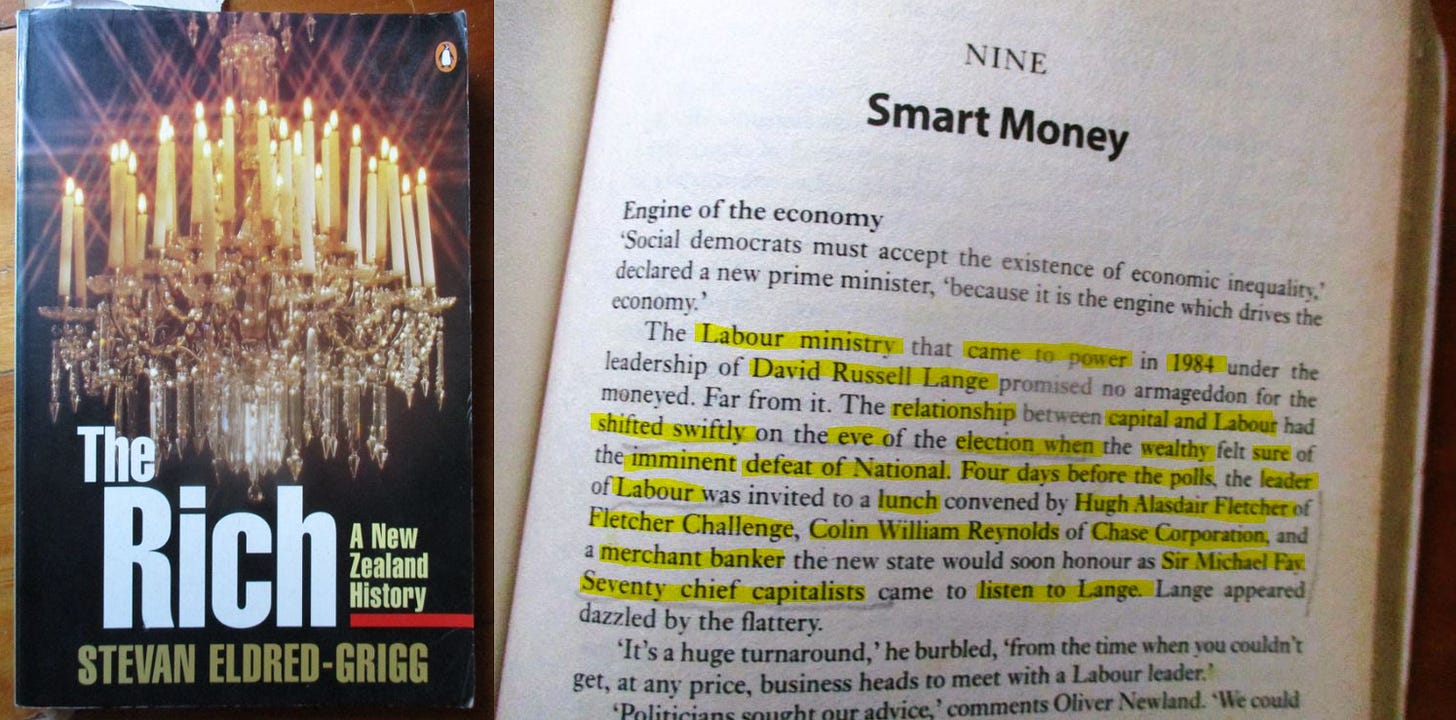

On July 10 1984, or four days before the nation went to the polls, 70 captains of industry listened to Labour Party leader, David Lange, over a private lunch convened by Hugh Fletcher, of Fletcher Challenge, Collin Reynolds of Chase Corporation and Michael Fay of Fay Richwhite merchant bankers. Big Business signalled a ‘sea-change’.

The date, July 10, was potent, because it was the 17th anniversary since New Zealand’s currency became fully and easily convertible with the US FED dollar when it switched from the imperial pound to the decimal dollar. This changeover occurred on Robert Muldoon’s first watch as Minister of Finance (4 March 1967 — 8 December 1972).

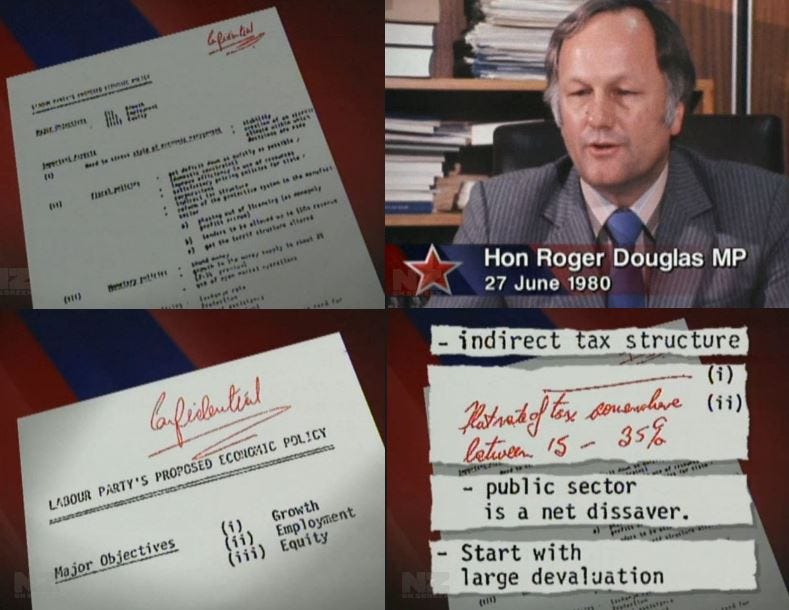

By early 1984, the business community knew Roger Douglas’s position, particularly as he was friends with Treasury Official and future president of the Business Round-Table, Roger Kerr, and also with Alan Gibbs, who set-up Chase-NBA’s N.Z. foreign exchange trading unit in the early 1970’s. Crucially, a February 1982 Labour Party Economic Policy document was kept secret because it prescribed radical economic policies in the detail such as slashing taxes on the rich, indirect taxes, public sector spending reforms and devaluing the currency. Kiwis were ensnared for vote harvesting.

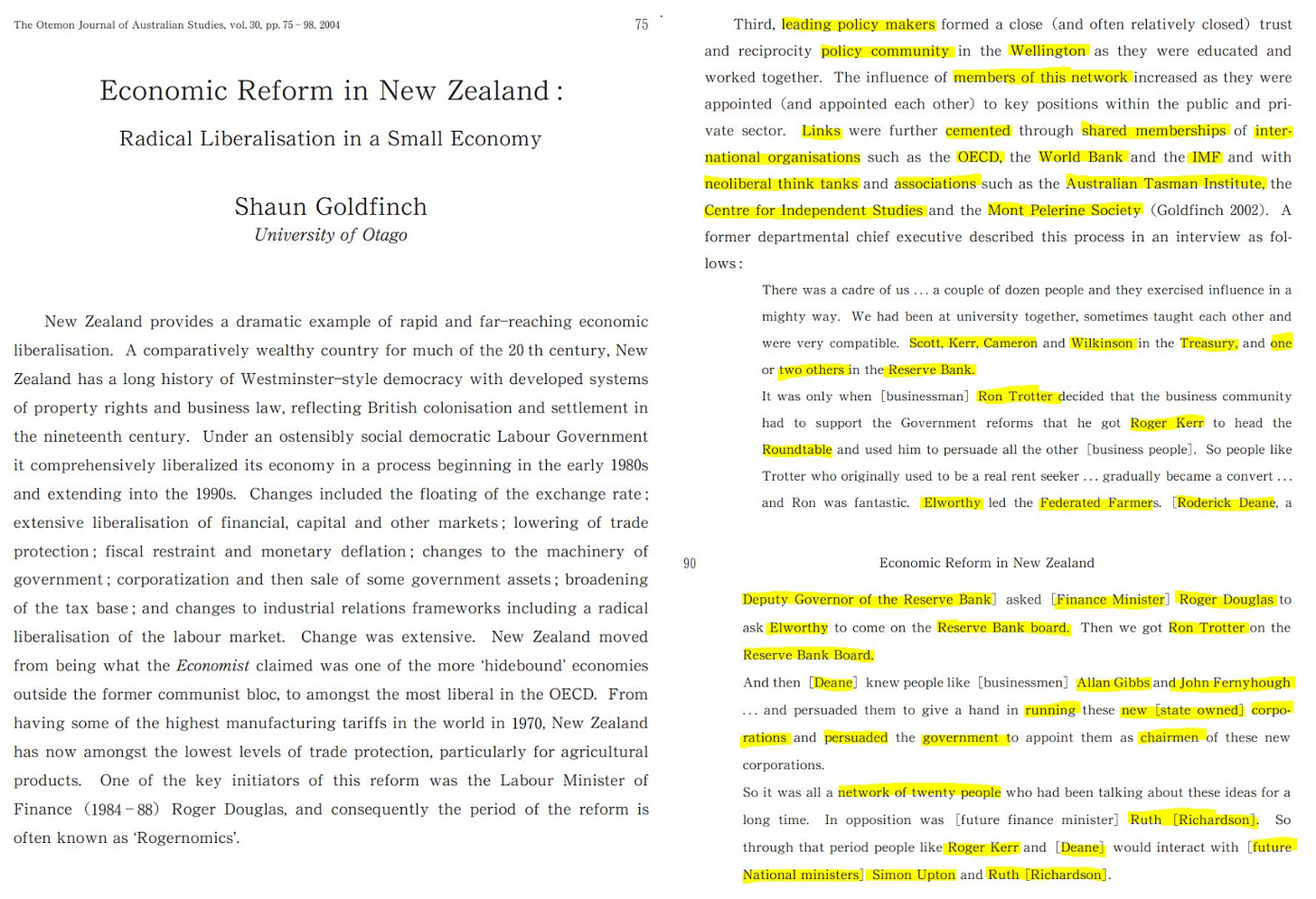

Thus, a reset of New Zealand was orchestrated with a political-financial coup of the incoming Lange Labour Government in July 1984, to implement the blitzkrieg corporate heist of the economy. A Neo-Feudal Cliqué comprising officials from the Reserve Bank, Treasury, and the NZ Business Roundtable conspired with an inner group of the Labour Party, to mete-out ‘free market reforms’ without an electoral mandate, across multiple sectors at speed to overwhelm opposition forces.

The ‘shock doctrine’ economic warfare was inflicted to transform New Zealand from an inefficient economy centrally-planned by Wellington bureaucrats, into a tollbooth economy centrally-planned by Big Finance, Big Agencies, and Big Think-Tanks. This 1984 reset altered the course of New Zealand, such that its new path headed toward totalitarian techno-feudalism. Economic impoverishment is key to undermining all rights, including freedom of speech, freedom of association and free of movement.

The idea, as I mentioned in part 1, was to create a top-strata of wealthy people, that would produce structural conditions wherein, “most New Zealanders would find the country an unaffordable place to live in 25 years time”, as Roger Douglas bragged at a private dinner in December 1986.* This Neo-Feudal Cliqué intended to replace most of the domestic population — including Māori — with vulnerable working class immigrants, and a wealthier imported professional service class, and a domestic-foreign capitalist class mixture. In the 1996 documentary series, Revolution, Douglas said he had hoped the Labour Government would be in power for 15 years.

But, aboriginal and indigenous Māori became a bulwark to challenge the sale of state assets. Not all of the blitzkrieg economic ‘reforms’ occurred, partly because Lange balked at Douglas wanting to privatize roads, hospitals and schools. And also due to lucky series of political incompetence, New Zealand switched to a Mix Member Proportional (MMP) electoral system in 1996. Therefore, while New Zealand has become an expensive place to live, the forces of transnational capitalism had to change tac to implement reforms at a slower pace, and with slicker propaganda.

The corporate raiding of New Zealand’s state assets — which involved the rapid, broad-scope corporatization, privatization and cartelization of state-owned commercial trading enterprises, infrastructure, and public services — was a racketeering operation that worked in cahoots with foreign interests.

Racketeering is the deceptive practice of offering solutions to problems created through concealed means to extort money, assets or pecuniary stakes in enterprises.

The siege of the New Zealand economy began in earnest with a speculative attack on the New Zealand dollar throughout the 1984 election campaign. An atmosphere of crisis was conjured in the immediate aftermath of the Lange-led Labour Party election victory of July 14 1984, to justify far-reaching economic ‘reforms’.

The Governor of the New Zealand Reserve Bank Spencer Russell played his devious part by adding to the emotional atmosphere of crisis. He kept the Reserve Bank closed on the Monday following the election, amid Muldoon’s theatrical ‘refusal’ to authorize a devaluation of the NZ Dollar during the power transition. In keeping with colluding players advancing the game, Russell and Secretary of Treasury, Bernie Galvin, dined that evening with bankers from the Bankers’ Association at the Le Normandie Restaurant, whose name for New Zealanders conjured World War II history.

Normandie, or Normandy, to New Zealanders is most famous for the Allied Forces’ Invasion of Normandy in Northern France in June and July 1944. The bankers appeared to express a dark élite humour. The codename for the decisive Battle of Normandy was Operation Overlord. Churchill had been skeptical about the Allied Forces invading Nazi-controlled France at Normandy, launched on 6 June 1944.

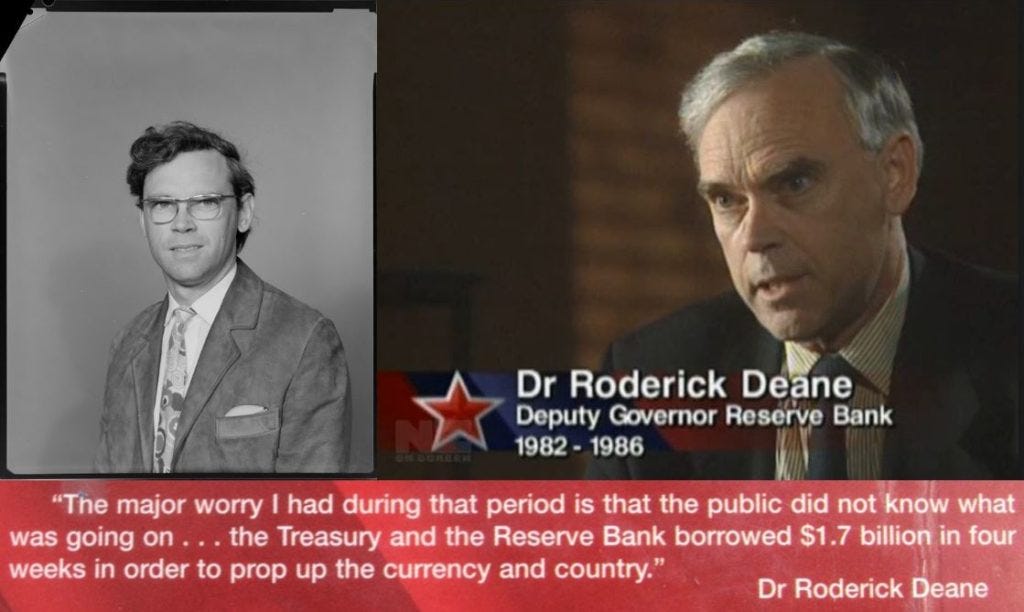

On Monday 16 July 1984, Reserve Bank official Dr. Roderick Deane called his bosses at Le Normandie Restaurant to put them in touch with “certain Ministers” of Muldoon’s cabinet. The perennially ‘stubborn’ Muldoon had expressed his own ideas on the six o’clock news about handling the currency crisis, causing the transition of administrations to stall until he capitulated the following day, Tuesday 17 July.

Adding to the spectacle, Muldoon’s role in this theater stirred a ‘constitutional crisis’.

‘Coincidently’, the day that the Reserve Bank closed the foreign exchange floor, was precisely 888 weeks since Muldoon had overseen NZ’s currency change-over from the imperial pound to the decimal dollar, on his first watch as Minister of Finance. This is potent. In 1688, when the Glorious Revolution deposed the Catholic King, James II, a protestant monarch was propelled to occupy the throne at Christmas, 888 years after Charlemagne was crowned Holy Roman Emperor on 25 December 800 AD. The installment of Prince William of Orange and his consort, Mary, to the English throne paved the way for the establishment of the Bank of England. The ‘Glorious Revolution of 1688’ — which resulted in Prince William of Orange becoming King William III on the British throne after they landed at Torbay, near Brixham, Devon, on November 5 with 250 ships — was secretly bankrolled by English Rosicrucian Freemasons, the Bank of Amsterdam, and Amsterdam Jews, and was part of a two-hundred year Venetian project to takeover Britain. James II was exiled from ‘Protestant England’.

Crucially, Sionist Rosicrucian Freemasonry came to rule over the British Monarchy and the Church of England, after having successfully achieved a political and business merger with the Dutch in 1688, as Nicholas Hagger found in his epic study, The Secret History of the West, that modelled for the patterns of revolutions, how secret societies plotted them and reasons for the subterfuge. Sionist Freemasonry is a revolutionary force committed to forging a universal empire under the rule of one monarch. French Templar Freemasonry developed into a revolutionary force committed to forge a universal empire under the rule of one federal republic. Thus, a hidden ‘Masonic Schism’ underpinned eight millenia of revolutions, wars, and coups d’état.

The Bank of England, as the first ‘proper’ central bank, worked as a means to fund domestic national development, imperial colonies, and finance wars, while enslaving the population with debt and taxes, since it was privately owned from 1694 to 1946.

Since the Reserve Bank’s currency exchange floor was closed 888 weeks after NZ’s currency changeover, it appears the fraternity who installed monarchs to thrones had encoded the event to communicate that there was a political puppet changeover underway — with red and white balloons. And Muldoon was now ancient history.

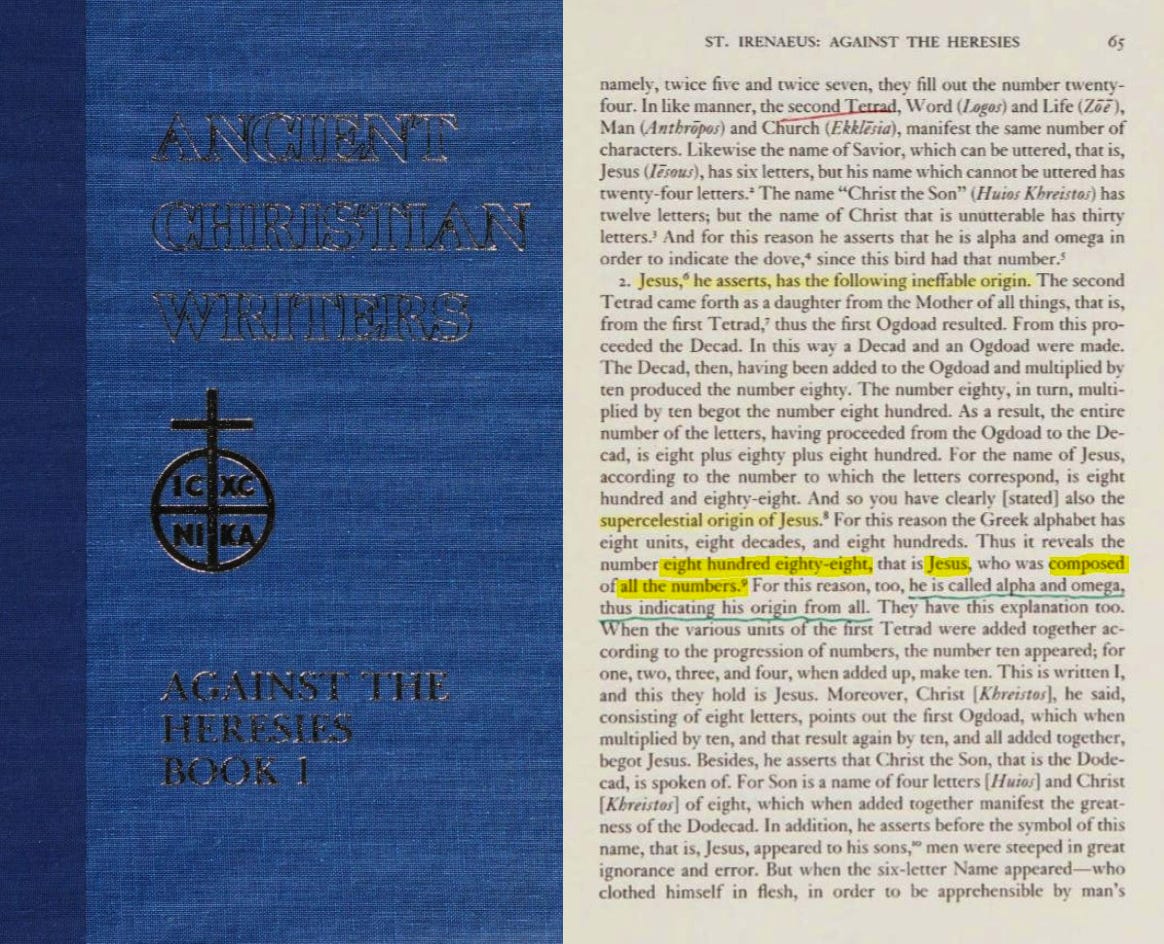

The number 888 is symbolic in various ‘mystical traditions’. In the heretical Christian Gnostic tradition, the application of numerology or gematria, to the Greek alphabet (which has eight units, eight decades and eight hundreds), the name ‘Jesus’ corresponds to eight hundred and eighty eight — as Saint Irenaeus of Lyons (130 AD-202AD) recounted in volume I, Against the Heresies; an attack on Gnostics.

A super-celestial infinite messianic metaphor was recast by the Gnostics. In his documentary, Zeitgeist, Peter Joseph, showed that key deity figures of city state cults in antiquity, all possessed common mythological elements. The trail-blazing scholar of world religions, Joseph Campbell stated in, Thou Art That: Transforming Religious Metaphor, the Virgin Birth metaphor, along with the Salvation and Resurrection metaphors, were commonplace elements in creation myths and religious cults across all major cultures. Christianity, along with the symbol-laden myth propagating ideology of Catholicism, was founded on plagiarisms of mythological elements from prior city state cults. Indeed, the two Abrahamic monotheistic religions — Judaism and Christianity — are entwined with plagiarisms regarding their mythological elements, that were lifted from prior city state cult franchises. These moves were made to resolve political crises of ruling class power rivalries to re-assert control.

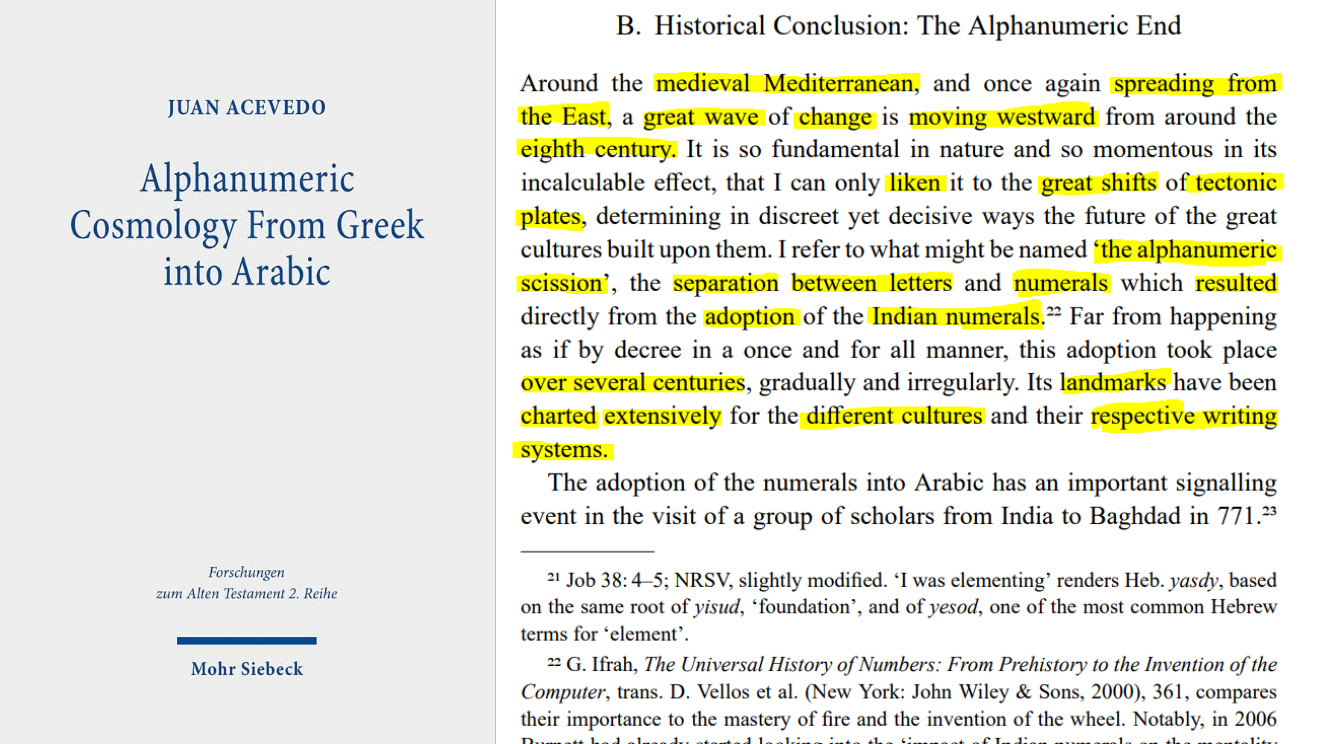

In his scholarly book, Alphanumeric Cosmology from Greek into Arabic, Juan Acevedo traces what he terms an ‘alphanumeric scission’ to describe a separation between letters and numbers with the adoption of Indian numerals across the Medieval Mediterranean from the East at around the eighth century onward. Although there were obvious benefits for computation in adopting decimal systems, the cosmological comprehensions of the universe that had been expressed in languages with unified letters and numbers, left a cascading effect on diverse fields of human endeavour.

In the Sumerian cipher, 888 corresponds to ‘alphanumeric code’. Sumeria was the first civilization that invented a market credit system with which to settle transactions.

Since the Reserve Bank’s closure of foreign exchange window occurred on Monday July 16 1984, after an orchestrated month-long currency attack, and coincided with a time duration of precisely 888 weeks since New Zealand’s currency changeover on July 10 1967 — this ‘coincidence’ suggests the bankers were codifying occult game moves.

The theater of the changeover of political power in the 1984 election, and it’s entanglement with a currency crisis reveals, in my opinion, a detectable subtext. The themes appear to demonstrate the enduring power of a transmarine banker fraternity planning their chess moves with occult, or hidden, knowledge. And with both a long range strategy to influence an environment to achieve desired objectives, as well as fleet-of-foot tactics to target opponents, capture allies and bewilder the masses.

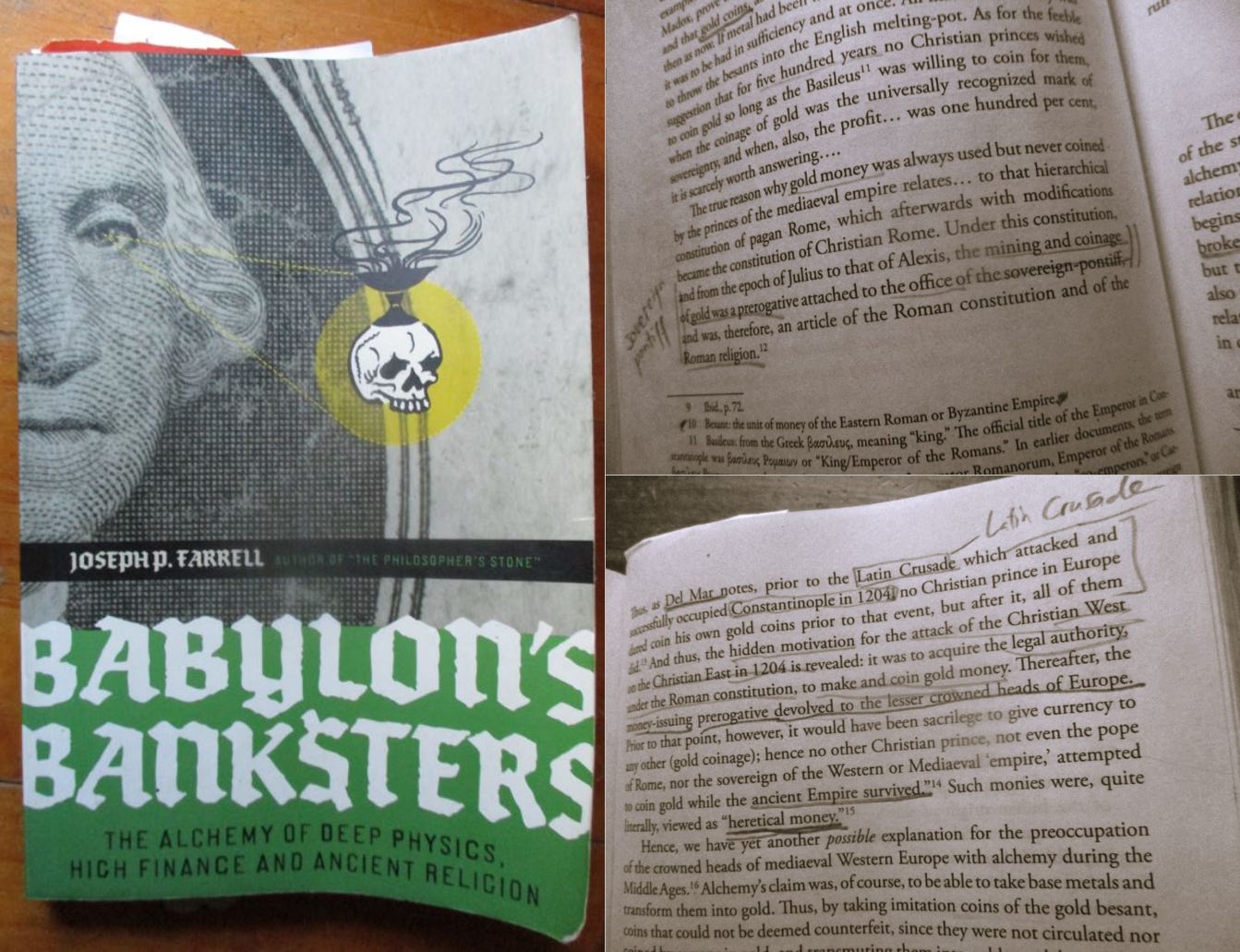

According to Joseph Farrell in Babylon’s Banksters, it took the Latin Crusaders occupying Constantinople in 1204 for Christian monarchs to win the sovereign power in Europe to mint their own gold coins. The Byzantine Empire shrunk and the Latin Empire, or Christian West, expanded. The franchise over mining and minting of gold — which had been the office of the sovereign pontiff — was over.

Thus, it would appear that this esoteric knowledge carried down through the ages in the brotherhoods, orders and masters of Islam, Christianity, and Hebrew traditions, had been weaponized into symbol sorcery for horrendous geo-political purposes.

Adding to the symbolism, Muldoon was known as one of the ‘Young Turks’, a nickname for a group of young rebels, because he had been one of a new batch MPs in 1960 who criticized the party’s senior leadership. The nickname derived from a political reform movement, called the Young Turks, in the early 20th century that favored the replacement of the Ottoman Empire’s absolute monarchy with a constitutional government. The Ottoman Empire collapsed at the end of World War I.

Conspicuously, in 1915 amid flak copped by Winston Churchill, as First Lord Admiral of the Royal Navy, for overseeing the military ‘disaster’ at Gallipoli, the 33°Freemason bragged that “Australia and New Zealand [were] smiting down in the last and finest crusade the combined barbarism of Prussia and of Turkey.” The brutal truth is the British Secret Élite devised the Gallipoli Campaign in the Dardanelles to sacrifice Australian and New Zealand men. Tsar Nicholas II was promised the port city of Constantinople as a ruse to keep the Russians in the war on the Eastern Front.

A ‘silent revolution’ — riffing off the English and French Revolutions, and the Allies’ Operation Overlord to rescue Nazi-occupied France in WWII — had begun in 1984.

Audaciously, the then-state-owned Bank of New Zealand was among the institutions that had bet against the dollar, as Marcia Russell found while producing a documentary series, Revolution, that she turned into a book, Revolution: New Zealand from Fortress to Free Market. NZ’s financial authorities could have revealed data from the Nostro accounts; a Wellington-based cheque clearing-house for currency trades.

Rod Deane — the Reserve Bank Deputy Governor — claimed the month-long speculative currency attack ‘forced’ the the Reserve Bank and Treasury to borrow $1.7 billion to prop up the NZ dollar’s value. In essence, the currency crisis was engineered by the Neo-Feudalist Sect as a coercive mechanism to post ransom notes. The ‘currency speculators’ remained ‘anonymous’, with the complicity of the financial authorities, so that they could get away with demanding tax-payer funded payments on their bets.

Therefore, it is ironic that Muldoon’s short-lived refusal to allow the Prime Minister-elect, David Lange to act on advice from Treasury and Reserve Bank officials triggered a ‘constitutional crisis’. After all, the former Young Turk’s theatrics led to the Constitution Act 1986, which clarified the power of the Governor-General to act on behalf of the Sovereign. Thus, Muldoon’s part in the staged theatrics assisted a trans- corporate political movement, fusing the British Monarchy to Neo-Feudalism.

In 1992, the Bank of New Zealand was sold for $1.4 billion, or 80 cents a share, to National Australia Bank, compared with the BNZ’s estimated current value of about $7 billion. The Bank of New Zealand was bailed out twice, to the tune of $1.3 billion tax dollars to cover its credit manufacturing exposure to the property markets in New Zealand and Australia that slumped following the 1987 Sharemarket Crash. In the second bail-out, merchant bankers Fay Richwhite paid $100 million for a 30% stake.

By December 1994, 13 New Zealand state-owned enterprises were sold for a mere $13 billion: New Zealand Steel, Petrocorp, Development Finance Corporation, Rural Bank, the National Film Unit, the Government Post Office, Telecom, Housing Corporation, Forest Corporation, the Bank of New Zealand, New Zealand Rail, Export Guarantee Corporation, and Government Computing Services.

And by December 1996, firms linked to the NZ Business Roundtable accumulated $12.542 billion of the $15.322 billion privatized assets, including Fletcher Challenge, which bought one-fifth, and the investor orbit of Ron Trotter bought a third.

At fire sale prices, Fletcher Challenge scooped up state-owned oil, gas and forestry resources for a fraction of their worth that generations of New Zealand Tax Herds had paid for, built and run on lands stolen, swindled and stealthily wrested off Māori.

These state assets included: Petrocorp for $801 million; a $254 million stake in Maui Gas; NZ Liquid Fuels for $203 million; Synfuels for $121 million; a $119 million stake in Taranaki Petroleum mining licenses; $687 million paid for Rural bank; $262 million in Forest cutting rights. The Forestry Corporation of New Zealand, or ForestCorp, was sold in 1996 for $1.6 billion to Fletcher Challenge (37.5%), Brierley Investments (25%), and a Chinese company, Citifor Inc (37.5%).

After six years of the Labour Government in power, many unions either collapsed or their power was eroded, despite the fact that as a broad interest group, they were significant in bringing the Labour Party into government, only to find the core of its Lange Cabinet had a class warfare policy agenda. Protests across New Zealand, big and small, were either ignored, disdainfully ridiculed, or treated as an exclusionary blackballing exercise by officials, the Business Roundtable and big businesses.

Tellingly, when James Bolger’s National Party won power in 1990, his new government was faced with a financial crisis too. Before it was privatized, the Bank of New Zealand asked for a second welfare hand-out in the form of a huge bailout $620 million. The BNZ claimed it needed the bailout to avoid collapse.

The Secretary of the Treasury, Graham Scott, who was also a member of Allan Gibbs Centre for Independent Studies think-tank, sounded a ‘warning’. Scott claims fiscal deficit that could blowout to an arbitrary figure of $5.2 billion (a multiple of the prime number 13), which seemed to slyly signal the Neo-Feudal Fraternity was advancing the game via the modus operandi of controlled crisis creation. In her 1996 book, Revolution: New Zealand From Fortress to Free Market, Marcia Russell wryly observed:

“It was like a re-run of 1984 with different actors.”

Where the Labour Government had hit the National’s core constituency first — the farming sector, with the sudden shock cutting tariffs on imported produce — the new National Finance Minister Ruth Richardson would waste no time attacking the sacred cows that Lange’s Labour would not kill: welfare reform and employment contracts.

For his part, Sir Ronald Trotter played an instrumental role in the Neo-Feudal corporate raiding takeover of the New Zealand economy during the mid-1980s to mid-1990s — when the Realm got mangled. Trotter was not only the inaugural Chairman of the Neo-Feudal think-tank, the New Zealand Business Round-Table (1985–1990). He was also Chairman of State-Owned Enterprises Steering Committee (1987-1988), which oversaw the preparation of state-owned commercial trading entities and infrastructure for sale. He was Chairman of Fletcher Challenge (1981-1990), which for a time was a literal cartel in its own right. In its mass buy-up of NZ companies, Fletcher Challenge served as a conduit to transfer ownership to foreign interests.

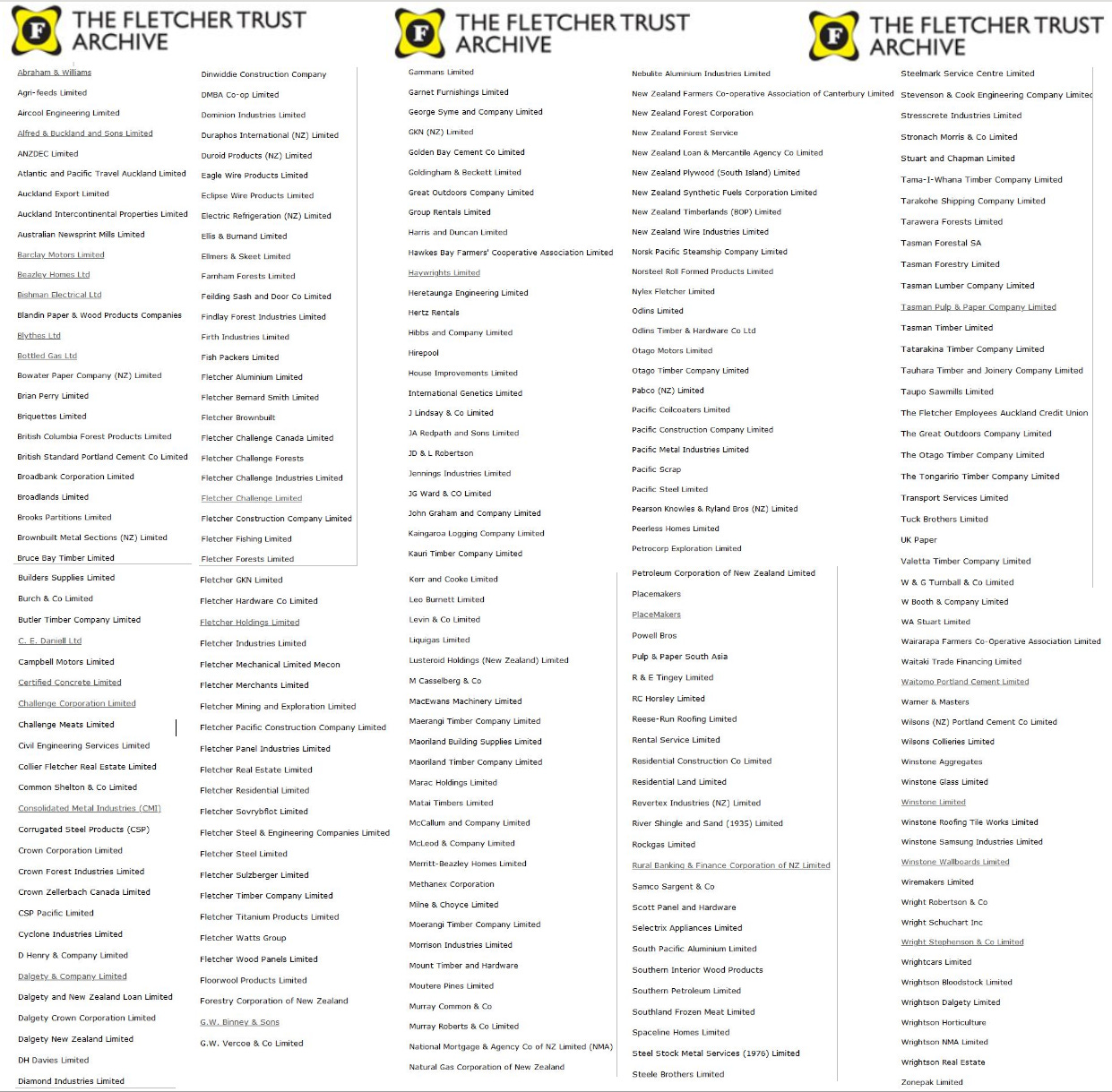

Fletcher Challenge was incorporated on 27th November 1981 when the son of Fletcher dynasty founder Sir James Fletcher I (1886-1974) — James (Jim) Fletcher II (1914-2009) — merged Fletcher Holdings and Tasman Pulp & Paper Co with Ronald Ramsay Trotter’s stock and station agents firm, Challenge Corporation, to form New Zealand’s biggest corporate conglomerate — for a brief time.

The agglomeration of firms such as Fletcher Construction, Fletcher Industries, Tasman Pulp and Paper, Pacific Steel and products such as Asbestos, Formica, Winstone particle board and Marac consumer finance — together resembled a Japanese zaibatsu, or a conglomerate controlled by one or two families.

The Fletcher Challenge Corporation was comprised of more than 250 companies, ranging from resource extraction, engineering, construction, manufacturing, distribution, wholesale and retail, across industries such as energy, steel, forestry, farming, building, as well as rural sector real estate, finance and trade in livestock. In short, Fletcher Challenge was a cartel in its own right, and Ron Trotter was sheriff. Fletcher Challenge regularly ranked around 200 in the list of the world’s biggest corporations, according to Selwyn Parker’s biography of James (JC) Fletcher II.

Meanwhile, when Ronald Trotter was Chairman of the State Owned Enterprise Steering Committee, he also became Chairman of Telecom (1987-1990), to prepare the state-owned telecommunications company for privatization after it was split off from the New Zealand Post Office. In September 1990, the New Zealand Government sold Telecom for $4.25 billion to Ameritech (45 per cent), Bell Atlantic (45 per cent), Michael Fay and David Richwhite (5 per cent) and Alan Gibbs and Trevor Farmer (5 per cent). Opinion polls at the time showed that 75% to 90% of Kiwis surveyed, were strongly opposed to the sale of Telecom, as journalist Colin James reported.

In four years, Telecom’s profits more than doubled to $528 million in 1994, at which time most of its 90 percent dividend was exported to its predominantly foreign-based owners, Ameritech and Bell Atlantic. In 1997, when the initial investors sold their stakes in Telecom, it was estimated that Ameritech and Bell Atlantic’s original combined investment of $3.8 billion made them a combined profit of $11.5 billion.

Gibbs — who became a director along with David Richwhite when Telecom was privatized — described his investment in Telecom as “the greatest coup of my business career”. Gibbs brought in Bell Atlantic and Ameritech and he and Fay Richwhite together ‘earned’ $100 million in brokering fees to organize the trade with Ameritech and Bell Atlantic and themselves. In 1996, Gibbs bragged the deal only required a down payment of $20 million, which was covered by the merchant banking fee, and the settlement could be made three years later (amid a sky rocket share price).

Merchant bankers Michael Fay ($920m) and former Business Roundtable vice-chair David Richwhite ($920m), who as partners of Fay Richwhite infamy, looted an estimated $800 million from Telecom ($600m) and Tranz Rail ($200m) for their orbit of corporate raiders in the first five years of operation as privatized toll-booths. Alan Gibbs ($555m), who founded the right wing think-tank, the New Zealand Centre for Political Research, made $300 million for his orbit of investors between 1992 and 1997 by looting the former state-owned enterprises — Telecom and Tranz Rail.

The stunning sell-off of state assets, including New Zealand Rail, Telecom, ForestCorp, Electricorp and the BNZ — represented an epic transfer of wealth upward and outbound, while their workforces were decimated. For instance, between 1987 and 1990, Roundtablers Alan Gibbs and John Fernyhough sacked 4,473 employees or 63% of ForestCorp’s workforce, in preparation for privatization.

Between 1987 and 1996, the Roundtablers chairing Telecom’s board, Ron Trotter and Peter Shirtcliffe, oversaw the sacking of 15,900 workers, or 65% of the workforce. Between 1987 and 1991, the Roundtablers of Electricorp’s board, John Fernyhough, Rod Deane, and Roger Kerr, sacked 2270 workers, or 38% of the workforce. Between 1987 and 1991, NZ Railways sacked 9,000 workers, or 60% of its workforce. Therefore, deep cuts to employment were inflicted, despite no one voting for (or against) such an eventuality because it was not tabled openly as an election platform.

Therefore, by astute crisis management, the ‘Big Business Community’ comprised of luminaries such as Fletcher Challenge, Brierley Investments, Chase Corporation, EquitiCorp and GoldCorp — in co-governance with their state management partners in the Lange and Bolger governments — exploited the blitzkrieg of economic reforms.

With exemplary callousness, New Zealand’s economy was bound to Australia’s, and it was those trans-Tasman corporate ownership, directorship and trade ties that bound Australasia to the ‘Trilateral Economy’ of North America, Western Europe and Japan.

Follow the Money: Interest Rates as Ransom Notes to State Managers

In this epic strategic sabotage of industry, between 1987 and 1995, tens of thousands of New Zealanders lost their jobs. In the public sector, 62,100 people were sacked by the state, while in the private sector, manufacturing employment dropped by 30%.

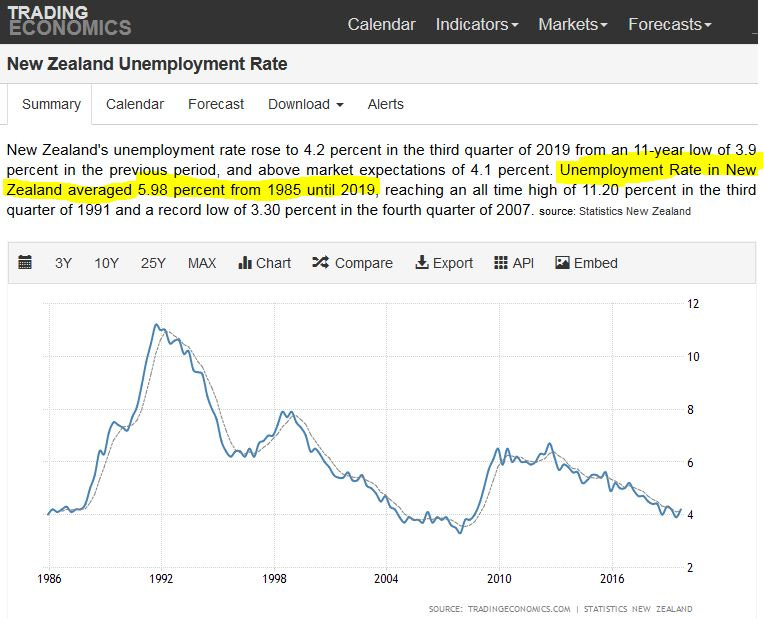

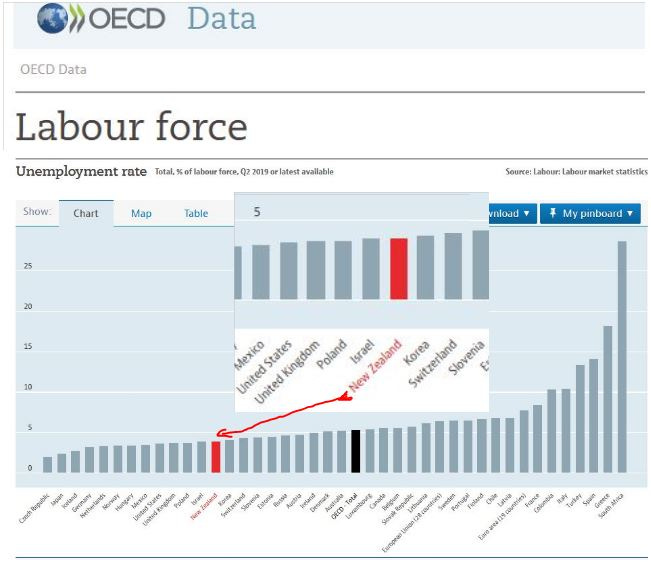

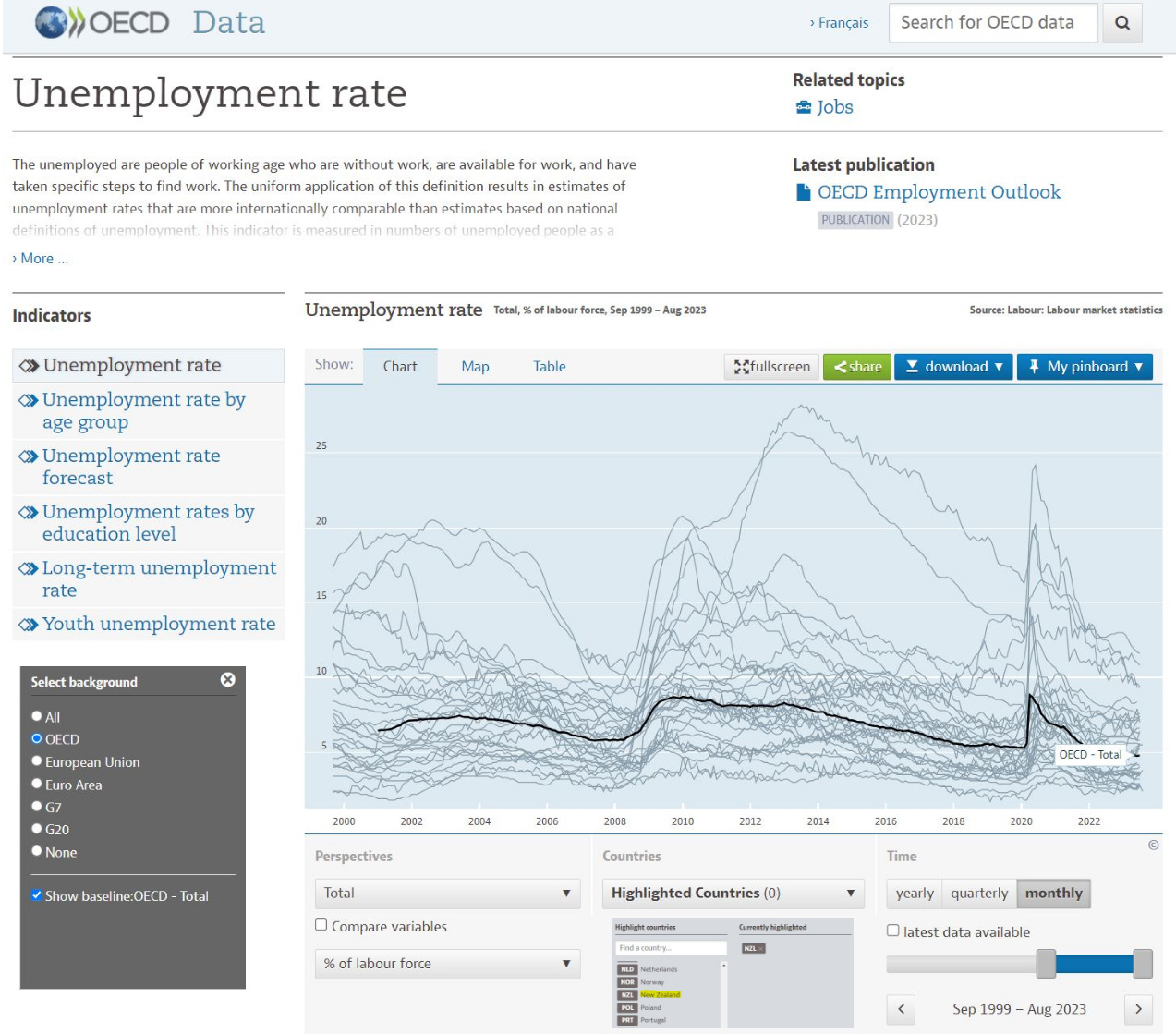

In 1983, the unemployment rate was 6% of the workforce, peaked at 16 percent in December 1992 and has averaged 6% from 1983 to 2014. It had been only 1% in 1971, when Nixon interrupted Bonanza to announce, in effect, a renewal of the financial speculation that triggered the 1929 Market Crash, which led to the Great Depression.

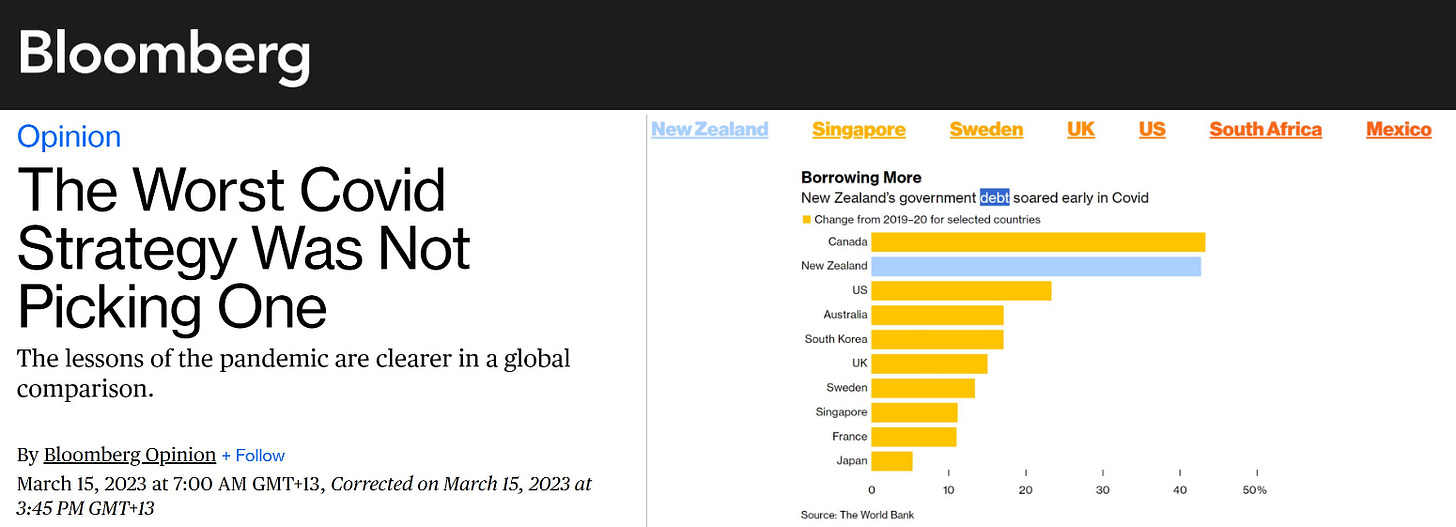

By liberalizing controls over the financial system in mid-1984, the Neo-Feudal Cliqué opted to favour high capital mobility and stabilize the currency, while scuttling achieving full-employment at a time when unemployment was already over 250,000 — out of 3.3 million people. Their callous intent was to drive unemployment upward, since large-scale visible poverty weakens workers’ wage and salary pay bargaining power, and delivers bigger profits for big businesses — as Alister Barry’s 2002 documentary, In a Land of Plenty: The Story of Unemployment in New Zealand revealed.

“The theory is that when unemployment is low, there’s always skill shortages and workers have the ability to demand higher wages, and to secure higher wages because the employers are competing amongst each other for scarce labour. And that pushes up costs and employers then recover those costs in terms of higher prices. And, so unemployment is quite a vicious, but effective way of dampening wage pressure and of, therefore, controlling prices.” — Peter Harris, Trade Union Economist, In a Land of Plenty.

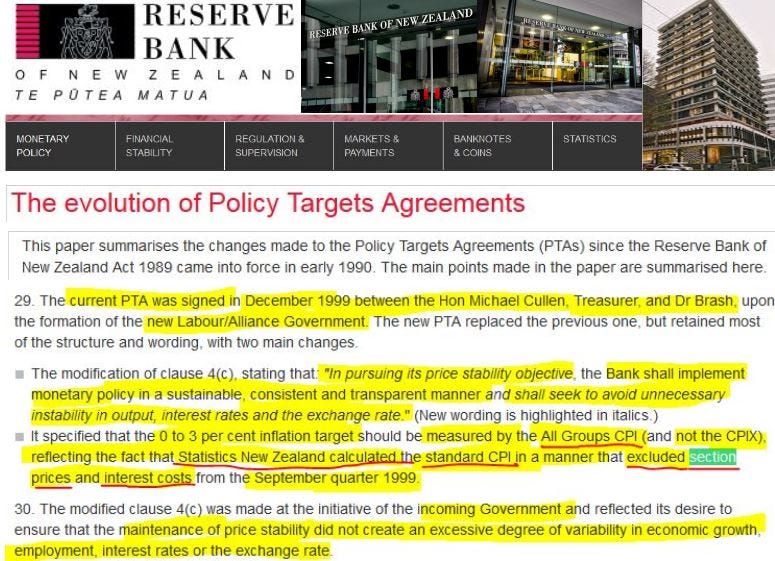

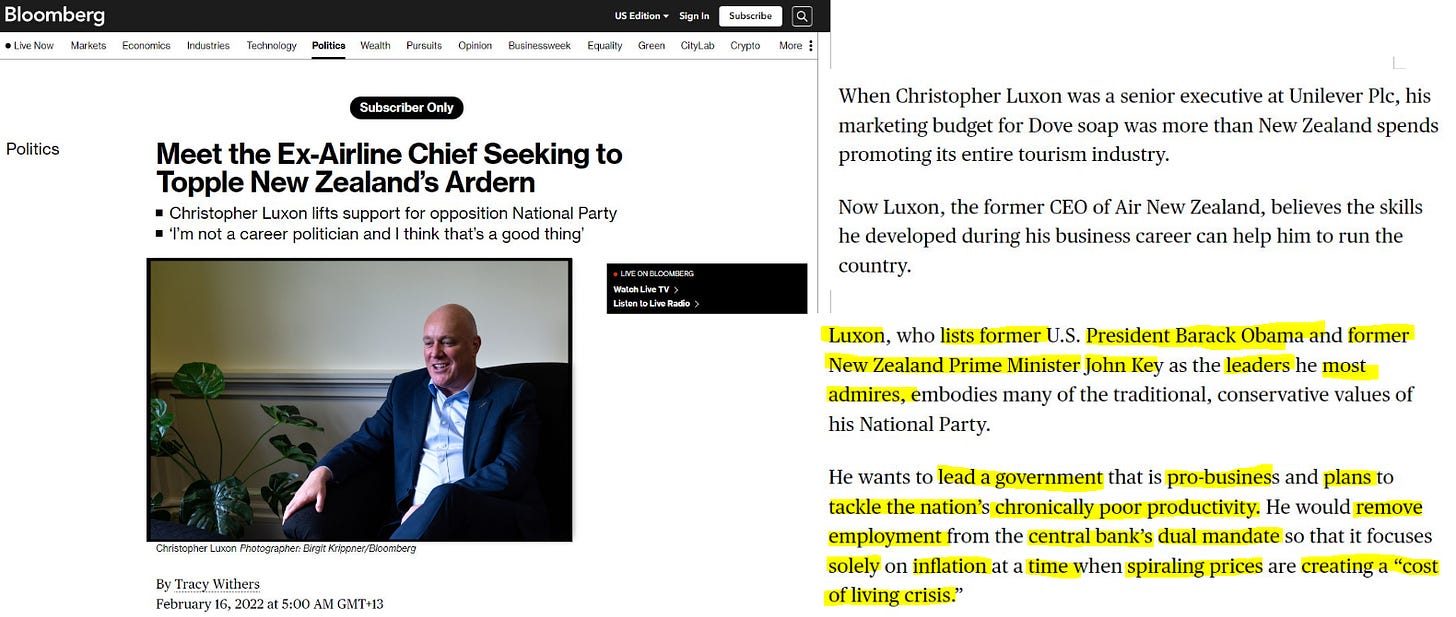

Thus, successive New Zealand governments since 1984 have colluded with the Reserve Bank, the Treasury and the cartelized banking industry to keep a fraction of the population out of work to maintain a low wage economy that delivers big profits for large firms. Since 1990, the main hidden mechanism that successive Governments have used to maintain persistent unemployment are an inflation targeting range called Policy Target Agreements (PTAs), that are reached between the Minister of Finance, who is head of the Treasury, and the Governor of the Reserve Bank.

This means the Neo-Feudal Crown, the Reserve Bank and Treasury inflicted a hidden structural unemployment policy in the 1980s and 1990s to drive down cost-side inflation.

Supporting persistent unemployment burdens the working class — which includes the ‘middle class’, who also need to work to survive — with unnecessary tax costs, while the rich and super-rich can avoid this tax burden with trust shelters. Persistent unemployment also inflicts personal well-being issues, inter-generational poverty and wider social problems that are better understood as strategic sabotages inflicted by techno-feudalist super-rich civil oligarchy and their servant ruling class élites.

Indeed, since mid-1984, the Reserve Bank — in collusion with the international banking cartel — have stealthily controlled the level of employment and unemployment by regulating the cost of wholesale credit accessible to banks for ‘loans’. The cost of credit on new and existing loans moderates economic activity, or business growth, and therefore the creation or destruction of jobs.

The record shows that once sufficient job destruction had occurred due to high interest rates causing business closures, or state managers inflicting mass sackings, or by the imposition of welfare reforms and individualized workers contracts, or via events from abroad such as the 1987 Share-Market Crash — the banking fraternity would allow the wholesale interest rate for the economy’s credit to be lowered through a new threshold — as I proved in my 2018 investigation, “Discretionary Idleness: Structural Unemployment as a Shock Doctrine Economic Warfare Tool in Neo-Colonial New Zealand.” Banking cartels price-fix too; not only oil or food cartels.

My “Discretionary Idleness” investigation proved the banking cartels’ collective control and influence over economic activity, and therefore political institutions, is exerted through interest rates, which is the fee that banks charge for continued supply of credit — the lifeblood of a Neo-Feudal economy. The credit supply is actually manipulated through setting the wholesale interest rate to control the unemployment rate — while the banking maintains a scarcity over interest-free cash.

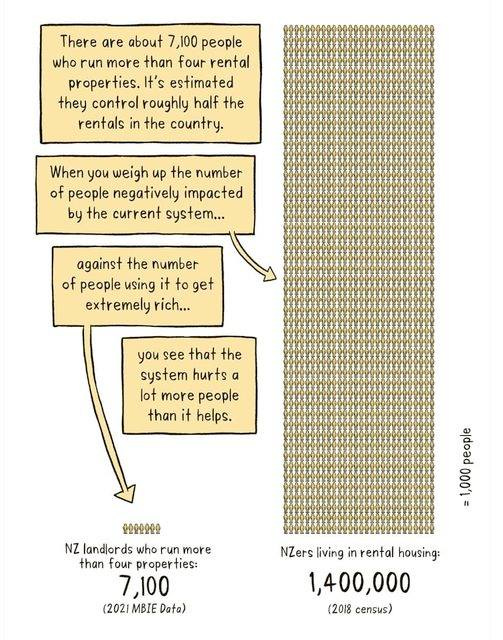

By setting the wholesale lending rate, or the Reserve Bank’s wholesale interest fee, New Zealand’s central bank regulates the level of unemployment through the cost of credit on new and existing loans, which moderates economic activity. Together these hidden transmission mechanisms maintain a low-wage economy. The reward for the neo-feudal oligarchies — who work cohesively overseeing cartels — is they maintain access to cheap wholesale credit, which fuels property speculation and drives up assets values for themselves, while neo-feudal peasants pay retail interest rates.

Let me demonstrate the Reserve Bank’s price fixing of the wholesale interest rate.

From mid-1984 through to the 1987 Share Market Crash, the Reserve Bank kept the wholesale lending rate, as measured by 30 day bank bill yields, at between 20% to 30% per annum most of the time, with short periods where it dipped below 20%. The 30 day bank bill yields were the primary indicator for the interest rate charged for the wholesale credit supplied to banks trading in New Zealand — until the Official Cash Rate (OCR) was introduced on March 17 1999. The Reserve Bank’s purpose was to inflict pain, knowing that by keeping wholesale ‘lending’ rates high, commercial banks would add on their ‘mark-up’ for retail interest rates. And businesses would be coerced to lay-off workers, or go bankrupt — amid high overdraft and loan rates.

Not surprisingly, in mid-1984 — when Labour became government — the official inflation rate, or the measure of the cost of living, soon rebounded to 16% from its Wage/Price Freeze suppressed value of 5% per annum imposed by the central planner extraordinaire, Robert Muldoon, in June 1982. New Zealand’s inflation rate peaked at 19% in June 1987. The double-digit inflation sent prices upward, including the costs of mortgages, rent, food and other essentials. While this situation exposed struggling business owners, low-waged workers and beneficiaries on fixed incomes to the most strife, the intention of officials at the Reserve Bank, Treasury and also the ‘Troika’ of Roger Douglas, Richard Prebble, David Caygill, was to use this economic sabotage as a brutal mechanism drive down ‘cost-side’ inflation, particularly labor costs.

Since interest rates are fees that transnational banking cartels charge for not withdrawing supply of credit funds, bankers use interest rates as a transmission mechanism to signal threats and promises to state managers. Three examples of credit coercion show a clear pattern of international and domestic bankers issuing ‘ransom notes’ through the inter-bank lending rate, as cues to the Reserve Bank and Treasury.

The first, shown here, occurred from 4 March 1985, when the New Zealand dollar was ‘floated’, meaning the currency’s value was unfixed and could now bob up and down in a sea of speculative ‘liquidity’ with other currencies. (The Reserve Bank conveniently abdicated its supervisory function inside the banks’ dealing rooms in early 1985).

This ‘float’ of the ‘Kiwi’ gave the international and domestic banking fraternities, and free-trading capitalists — euphemistically termed ‘speculators’ — the opportunity to send the Reserve Bank’s wholesale lending rate (the overnight inter-bank lending rate) shooting up to a Banana Republic rate of 265% on March 8. The speculative spikes averaged out to an all time high for the ‘cash rate’ at 67% for March 1985.

The spike in interest in this month was, in effect, a ‘price signal’ ransom note sent by the banking cartel to the Reserve Bank. In effect, the encoded message in this financial data was telegraphing: ‘move on to phase two of the shock therapies’.

State managers corporatized public sector entities prior to sale. Meanwhile, the banking fraternity prolonged high interest rates to inflict a strategic sabotage of industry. Business closures, mass lay-offs and down-sizing became commonplace.

By March 29, the ‘cash rate’ dropped to 21.5%, and fluctuated between 20% to 30% through 1985 to 1987, amid high credit demand to service the new high-rollers’ crass consumption, and to feed a commercial property boom in the bigger cities such as Auckland, Wellington and Christchurch, and to exploit an overheated stockmarket.

Once the inflation rate dropped by 6% in two months at the end of 1987 following the Wall Street-triggered October 1987 Sharemarket Crash, the Reserve Bank’s wholesale lending rate (or ‘interbank cash rate’) pierced the 20% threshold, ‘permanently’.

Crucially, between 1984 and 1987, the pace of capital accumulation for investors and speculators was rapid, and was reflected in the share-market price index, which grew 140 percent, thereby outpacing the general inflation rate, or ‘costs of living’. Moreover, insiders, who could obtain credit from Australia at 5% interest, could bet big.

Thus, in NZ, the relatively high interest rates would eventually drive down inflation as businesses went broke, or laid-off workers. Meanwhile, well-resourced big businesses could access cheaper international credit to exploit the share-market and commercial property market booms to achieve rapid inflation of asset portfolios.

Therefore, Treasury, the Reserve Bank and the Douglas ‘Treasury Troika’ avoided explaining this vicious scenario that was in essence an asymmetric inflation paradigm.

The third example of data showing the wholesale interbank credit rate was used as a ‘ransom note’ to state managers to listen to ‘price signals’ — by getting their policies to reflect free market orthodoxy, or ‘market fundamentals’ — occurred at the end of July 1991. This was a year and a half into the Bolger National Government’s first term.

On 30 July 1991, the ‘30 Day Bank Yields’ finally fell below 10% one day before Finance Minister Ruth Richardson performed her ‘Mother of All Budgets’ ‘Hostage Exchange Ritual’ in Parliament. This ‘permanent’ penetration through the 10% threshold demonstrated ‘the market’ voted approval for deep cuts to welfare payments, the end of the state’s home-ownership support programmes, and the passage of the Employment Contracts Act, which was designed to drive down wages and therefore cost-side inflation, as Revolution: The New Country showed.

Thus, on the 130th Anniversary of Parliament passing an act to incorporate ‘The Bank of New Zealand’ (July 29th 1861), the wholesale interest rate was kept above 10% pa. In other words, during New Zealand’s second revolution, the banking fraternity riffed off their Colonial Era forebears, who established the Bank of New Zealand to bankroll the consolidation of the nation, by becoming the Colonial Government’s banker during the New Zealand Masonic Revolutionary War of 1860-1872. By the mid-1860s, the BNZ’s owners received a steady 10% dividend, having successfully defeated the ‘Kingites’ in the Waikato War of 1863-64, who were framed as being in rebellion.

Ergo, with the defeat of the rebellious unions, the Neo-Feudal Sect rewarded the well-healed with access to relatively cheap credit with which to inflate the housing market.

In 1991, the deep cuts to welfare payments would ensure that Treasury could prioritize debt servicing to private ‘creditors’ who buy Treasury bonds and securities.

Among the government’s creditors is the transnational and domestic banking cartel.

The first measure was the passage of the Employment Contracts Act of May 15 1991 that provided a mechanism to establish individual employment contracts to end collective bargaining in workplaces and hand more bargaining chips to big businesses. Thus, the Knights of the Business Roundtable won a key ‘Monopoly Card’.

The second two measures were delivered in the 1991 budget to the House of Representatives — frivolously dubbed the ‘Mother of All Budgets’; a riff off of Gulf War I, which was inflicted to re-invigorate Fortune 500 firms. The Bolger National Government made deep cuts to welfare payments and entitlements — including state home-ownership support assistance, and commenced a sell-off of the state’s mortgage portfolio. The 1991 Budget also introduced user pays fees for schools and hospitals.

Therefore, with these three examples, I have shown how the banking fraternity would allow the wholesale interest rate to ‘permanently’ drop through the thresholds of 20% and 10%, once state managers passed legislation to unleash market power to drive down inflation. To recap, the initial currency attacks of mid-1984, captured the incoming Lange Cabinet to ‘de-regulate’ the financial sector, so it could inflict economic warfare on all sectors of the economy, to sabotage society. Upon ‘floating the currency’ in March 1985, New Zealand’s state managers received another ‘ransom note’, to get on with phase two, which involved preparing the public sector for corporatization, with the idea of selling off as many state assets as possible. A 6% drop in the inflation rate following the 1987 Sharemarket Crash resulted in a ‘reward’ of the wholesale lending rate dropping below the 20% threshold. In 1991, the passage of legislation and budget measures to permit individualized employment contracts, cut unemployment benefits from $144 to $130 per week, and introduce tolls for education and health — while maintaining the Lange Government’s goods and services tax — resulted in a ‘reward’: the wholesale lending rate dropped below the 10% threshold.

Former Reserve Bank director Suzanne Snively (1985-1992), stated in Alister Barry’s documentary, In a Land of Plenty – The Story of Unemployment in New Zealand:

“It was a manageable thing for the Reserve Bank to initially use employment and unemployment as a way to get wages down. It was easier that any other means of getting inflation down. So they used it.” — Suzanne Snively, Reserve Bank director (1985-1992)

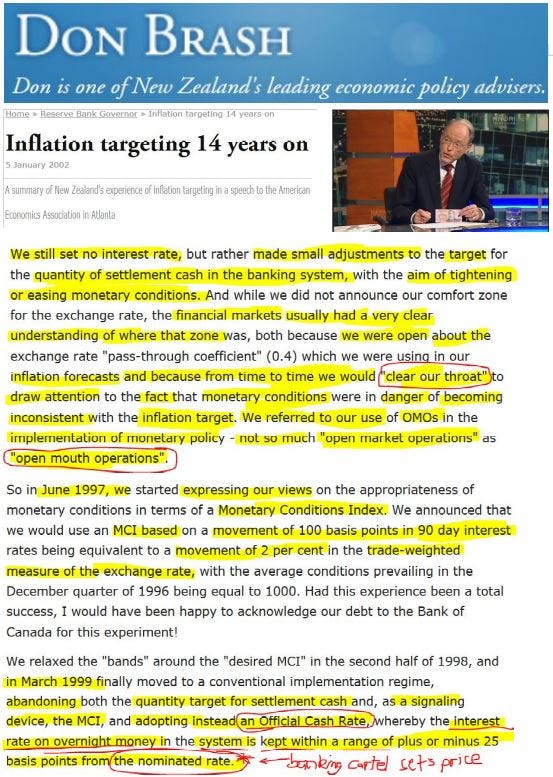

When Donald Brash became the Reserve Bank Governor in 1988, he used ‘inflation targetting’ to calibrate the wholesale interest rate for credit supplied to the New Zealand economy. To bring the general inflation rate into a 1-3% band, the NZ Reserve Bank initially made small changes to the quantity of ‘settlement cash’ in the banking system — with the goal to tighten or ease the supply of currency, or ‘cash’, with which to settle transactions. The international and domestic banking cartel would follow suit by setting the overnight inter-bank lending rate within a tight band close to the Official Cash Rate (OCR) to settle their transactions. As time went on, the Reserve Bank took a ‘quantitative approach’ that involved holding the liquidity in the banking system stable, which was evidently an easy task because of the free float of the NZ dollar and easy capital flows to fund Treasury bond sales to finance Government fiscal deficit spending — Mr Brash explained in a 2002 speech.

In practice, this wholesale interest rate usually matches the overnight inter-bank lending rate, meaning the Reserve Bank takes its cues from the international and domestic banks about the wholesale fee charged for credit, euphemistically termed ‘interest’. Brash stated that from time to time he would perform “open mouth operations” via the news media to draw attention to monetary conditions endangering the inflation rate target. Brash’s whimsical term “open mouth operations” riffed off the Federal Reserve banking cartel’s ‘Open Market Operations,’ whereby the Federal Reserve purchases and sells off securities in the open market to expand or contract the currency supply, and in turn regulate un/employment to control the inflation rate.

Brash recalled that to express Reserve Bank’s preferences for financial conditions, he would hold another press conference about a week to ten days later to essentially say ‘that’s about right’ to ‘the market’ — which gave the appearance to the public and the news media that the Reserve Bank did not know what it was doing.

These implied threats were enough to adjust the supply of scarce ‘settlement cash’ resulting in an easing or tightening of monetary conditions, in conjunction with a monetary policy tax on deposits to discourage banks holding too much cash. In this way, the supply of credit would shrink or expand, and the fee for not withdrawing that supply — interest — would fluctuate in price, thereby ‘heating’ and ‘cooling’ economic activity on the basis of the ‘loan’ approvals or declines, and their costs.

However, if monetary conditions were tightened too fast, inflation could go through the bottom of the target. Communicating these ‘market signals’ via Reserve Bank pressers were clumsy. The bank innovated by producing Quarterly Inflation Forecasts.

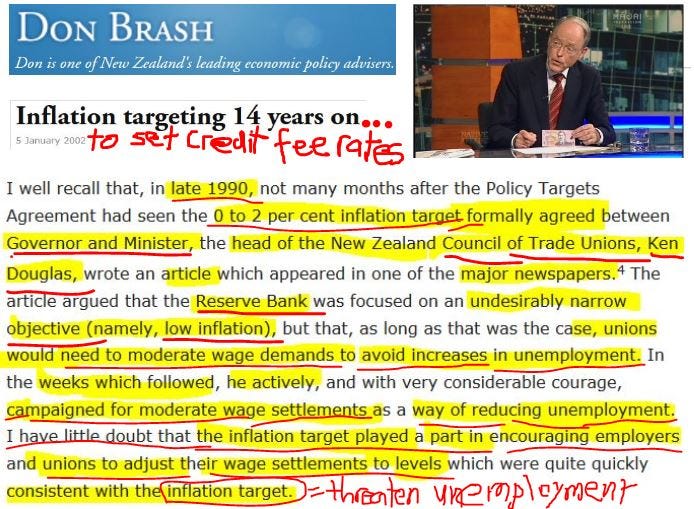

In his January 2002 speech to the American Economics Association conference, Atlanta, Don Brash recalled an anecdote about a labour union boss apparently capitulating to the new inflation targeting regime back in late 1990.

Evidently, the president of NZ Council of Trade Unions, Ken Douglas, wrote an opinion piece stating that since the Reserve Bank was focused on low inflation, then unions would have to revise their wage demands to avert rises in unemployment.

Ergo, unions learned the new rules of Monopoly, rolled the dice on their turns and paid more rent. Brash makes the connection between maintaining low inflation — by keeping wage increases to a minimum — and restricting employment by ratio.

This means that Ken Douglas understood the link between the Reserve Bank setting an inflation target, which the banks would take as a cue to set their wholesale interest rates among each other, as a mechanism for controlling the level of wholesale credit available in the economy for new business loans. If unions increased wage demands, interest rates would rise, and less loans would be granted, because many applicant’s businesses would not be able to afford the higher credit costs, and more enterprises would fail, and therefore, there would be less job creation and more job destruction.

And, in turn, the consequences were that the banks’ manufactured loan funds could be restricted with higher interest rates. This would curtail employment growth. If the unions submitted, there would be job growth in a low-wage economy.

However, all of this ‘inflation-targetting’ is from the banking fraternity’s perspective.

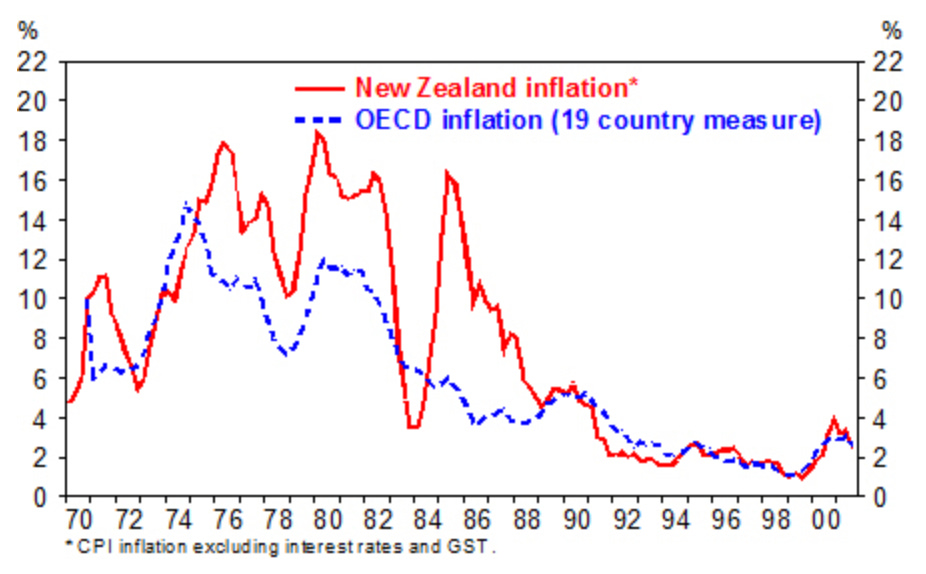

As this graph sourced from Don Brash’s website shows, the inflation rate (Consumer Price Index) excluded interest rates, as well the new goods and services tax. In other words, the real inflation rate impacting Kiwi households, urban enterprises and rural farms was much higher, especially in the mid-1980s when bank overdrafts were up to 33% interest, and a 10% GST toll on transactions was introduced on October 1 1986.

The Crown/Reserve Bank machinations continued throughout the late 1990s on Don Brash’s watch. Under the Shipley National Government, Statistics New Zealand began using a CPI that excluded section prices and interest costs from its measure of general inflation in the September Quarter of 1999. With this Government fiction, state managers could downplay the true cost of living for Kiwis as the house prices soared.

From the December 1999 quarter onward, the Clark Labour Government set the Reserve Bank an inflation target of 0 to 3 percent, that measured with All Groups CPI which counted section prices and interest costs. However, the Clark Labour Government failed to direct Stats NZ to include these crucial living costs.

With this sleight of hand, the Clark Labour Government gained a more accurate picture of general inflation across the economy, and therefore constructed an asymmetric information gap with which to escalate the Shock Doctrine economic warfare paradigm. Naturally, the Clark Labour Government neglected to inform households, unions and poverty advocacy groups that they would be essentially flying blind about the real inflation rate if they continued to rely on Stats NZ’s new standard CPI inflation measure. The Beehive’s Labour tax farmers were very accommodating of the credit manufacturers (bankers) to continue extracting ‘milk and honey’.

In these ways, the Neo-Feudal Crown, Reserve Bank and Treasury continued to inflict this hidden structural unemployment policy in the 1990s to achieve and maintain low general inflation. This persistent structural unemployment policy continues today, despite tweaks to the revamped Policy Target Agreement (a sanitized name that hides its vicious purpose). Therefore, persistent structural unemployment was established through mass public and private job destruction, and extortionist interest rates.

To recap, the Reserve Bank’s inflation-targeting policy works by setting the interest rate, directly or indirectly, for wholesale credit supplied to the economy from international and domestic banks and is a key policy component for maintaining structural unemployment. Despite the revamped Policy Target Agreement allegedly seeking to achieve maximum sustainable employment, it’s ultimate goal is still to reward the Neo-Feudal Cliqué with cheap abundant credit to expand the wealth gap, while the working class are subjected to low wage economy rewards and disciplined with the tax burdens of a crisis-ridden society (while the super-rich thrive above).

The supply of cheap credit to fund a landlord house flipping vulture culture continued because the Ardern’s Labour capitulated to pressure from the Neo-Feudal Cliqué, and backed off from expanding the existing thin sliver of a capital gains tax regime. Thus, the inflation rate was fudged to hide the true pain inflicted on Kiwis.

Bragging Bankers, Bigoted Beer Barons and Brazen Baby-Kissers

In Revolution, Roger Douglas brazenly said his reforms had “dismantled privilege”.

Don Brash had advised Douglas on the free market ‘reforms’, or policy shocks, in the 1980s. When he appointed as Governor of the Reserve Bank, Brash advocated scrapping the minimum wage, privatization, lower taxes cuts to welfare payments.

Beer baron Douglas Myers, who chaired the Business Roundtable from 1990 to 1997, once bragged that “the cheque book is always open for political parties” so long as prove their worth. Myers noted that the Employment Contract Act speed up the capacity to make profits since it was designed to drive down wages quickly by shifting workers onto individualized contracts and away from union protections. In other words the Reserve Bank Governor and the new Finance Minister worked as glove puppets for the Big Business interests that the Business Roundtable represented.

As one of the key heist perpetrators, Roger Douglas, boasted of his shock therapy modus operandi to overwhelm multiple sectors of New Zealand, to 400 attendees at a Mont Pèlerin Society conference in Christchurch in 1989. Jane Kelsey noted in her book, The Fire Economy, Douglas published this articulation of his ‘blitzkrieg strategy’ in ‘Chapter 10: The Art of the Possible’ of his 1993 book, Unfinished Business. Douglas’s book was published as his manifesto for the ACT Party, which was largely bankrolled by corporate raider, Sir Alan Gibbs, ahead of the first MMP election in 1996. Act’s role is to test the political waters of radical policies, to save National hemorrhaging voters.

Among the Clergy of 400 Shock Doctrinaires were three New Zealand Members of the Mont Pèlerin Society: former ForestCorp and Electricorp chairman, Sir Alan Gibbs; former Treasury official, Electricorp Director and NZ Business Roundtable Executive Director, Sir Roger Kerr; and National MP and future Health Minister, Simon Upton. Two British members of the Mont Pèlerin Society, and its offshoot, the Institute of Economic Affairs, who attended were, Lord Bauer and Lord Harris of High Cross.

Also present at the Christchurch meeting of the Mont Pèlerin Society in 1989 were:

Former Reserve Bank director, Telecom Chairman, NZ Business Roundtable Chairman, and member of the Tasman Institute, Sir Ronald Trotter; Chicago Boy and Tasman Institute member, John Fernyhough; former Reserve Bank official and State Services Commission chairman and Electricorp Director, Sir Roderick Deane; NZ Business Roundtabler and Lion Nathan brewing magnate, Sir Douglas Myers; NZ Business Roundtabler and merchant banker, Sir David Richwhite; Centre for Independent Studies member and former Reserve Bank and Landcorp official, Sir Peter Elworthy; NZ Business Roundtabler and property magnate Sir Michael Friedlander; NZ Business Roundtabler and Telecom chairman, Sir Peter Shirtcliffe; former economist and future ACT Party leader, Rodney Hide; future National Party Finance Minister, Ruth Richardson; then-Reserve Bank official Donald Brash; former Treasury official, CS First Boston merchant banker and future billionaire, Stephen Jennings; Centre for Independent Studies member, Bryce Wilkinson; and also Centre for Independent Studies member, former Treasury official and CS First Boston and Fay Richwhite merchant banker, Rob Cameron. Mont Pèlerin’s network was extensive.

The Neo-Feudal Cliqué had used the Labour Party to inflict economic warfare on New Zealand enterprises. Robert Muldoon’s Government could not have implemented the blitzkrieg without major backlash, since it was the ‘business party’ of conservatives.

In 1989, National Party MP and Mont Pèlerin Society member, Simon Upton, told the NZ Herald, a newspaper founded to promote the Masonic New Zealand Wars:

“New Zealand is well situated to be a supplier of raw materials to richer neighbours, a home to well fed peasants who hopefully would not unsettle things for the outward looking elites.” — Simon Upton quoted in New Zealand Herald, December 30, 1989.

Mont Pèlerin Agent Saboteur Simon Upton, who later became Bolger’s Health Minister, was one of only three New Zealand Mont Pèlerin Society members.

The other two Mont Pèlerin Agent Saboteurs were: then-ForestCorp and Electricorp chairman, and founder of the Centre for Independent Studies, Sir Alan Gibbs; and former Treasury official, Electricorp Director, Sir Roger Kerr.

Kerr became NZ Business Roundtable Executive Director after Sir Ron Trotter.

In other words, the ‘Mont Pèlerin 400’ were well aware economic warfare had been inflicted on New Zealanders. The ‘400’ included Mr Stephen Jennings, who is now a board director of the New Zealand Initiative, a think-tank that resulted from a 2012 merger between the NZ Business Roundtable and the New Zealand Institute.

In this ‘New Zealand Edition’ of Monopoly, Credit Suisse First Boston’s Wellington office lured four Treasury officials into its employ, Bryce Wilkinson, Rob Cameron, Susan Begg and Stephen Jennings to advise Treasury on state sector ‘reforms’.

Jennings has the particular distinction of being mentored by both of ‘the two Ronnies’ during the Halcyon Days of NZ’s Neo-Feudal Siege: Ron Trotter and Ron Brierley.

Jennings started out in Treasury in 1984 at the beginning of the Lange-Labour Ministry and then moved to Credit Suisse First Boston’s Wellington office — where he advised the New Zealand and Australian governments on privatization, state enterprise restructuring and a variety of private sector mergers and acquisitions and capital markets transactions. In 1992, he was sent to London and in 1993 to Moscow by Credit Suisse First Boston to set up an investment bank with a colleague, Boris Jordan. From the Metropol Hotel, Jennings and Jordan connected with Boris Yeltsin’s privatization minister, Anatoly Chubais, hired 300 students from Moscow State University, and consulted with academics from Harvard University’s ‘Russia Project’, an initiative funded by the US Government that was designed to wrest ownership of the Russian economy from the Russians. The billionaire — who made his fortune privatizing 5,000 former Soviet-bloc enterprises — kept Boris Yeltsin’s Neo-Colonial regime close, with Russia’s first deputy prime minister and finance minister, Yegor Gaidar, retained on Renaissance Capital’s advisory board, as I reported in 2017.

Prior to the first MMP election of 1996, Jennings sponsored a secret group of six people to study the political landscape of New Zealand across every electorate in order to predict the likely outcome.** This secret group then traveled to Germany with local body voting records, census data, and electorate maps where the now-billionaire Jennings gleaned the expert opinion off a German Green Party member familiar with Mixed Member Proportional election systems, while the group watched the periodic conversations they could not hear from an adjoining room, through one-way glass.

Although they did not always get the reasons or the margins right, Jennings’ secret group predicted accurately who would form the governments of New Zealand for seven elections, from 1996 to 2014. ACT was founded by the neo-feudal libertarian Allan Gibbs, who is credited with bankrolling the Party.

Jennings’ wealth reportedly peaked at $5 billion when he was chairman of Renaissance Capital, which the ‘Paradise Papers’ showed was registered in Bermuda, a tax haven. The former Treasury economist’s net-worth is presently over $1 billion. On September 13 2018, the Waitara-born billionaire became a director of the New Zealand Initiative think-tank following his appointment as its CEO.

The NZ Companies register classifies the think-tank as a business association with the legal status of limited liability company. Although the New Zealand Business Roundtable was established in 1980, it became more formalized in 1983, with a founding membership roster that included Douglas Myers, the beer baron. This was the same year that property tycoon, Bob Jones, founded the New Zealand Party to split the National Party’s vote; a chess political move to propel the Labour Party into power.

By 1998, the Business Roundtable’s corporate membership resembled a Who’s Who of a New Zealand ‘Who Dunnit? Monopoly Heist’. The corporate roster included: AMP, ANZ, ASB, BNZ, Brierley Investments, Comalco, Electricorp, Farmers Deka, Fay Richwhite, Feltex Carpets, First NZ Capital (CS First Boston, now Jarden), Fletcher Challenge, Gibbs Securities, Goodman Fielder, Heinz Wattie, Lion Nathan, National Bank, Saatchi & Saatchi, Telecom, Toyota, Westpac, Whitcoulls and Woolworths.

Selling the ‘Kiwi Family Silver’ Redux

A redux of selling the ‘Kiwi Family Silver’ occurred on John Key’s watch, despite National re-winning power with a stealthy dirty politics machine. In response to calls for a referendum on the issue of state assets sales, the characteristically snide Key said that his Government had a mandate to do so, adding, “it’s called a general election”.

The agenda was signalled prior to the 2008 election, when Key said National would not privatize any state assets in its first term. In this way, Key signalled ‘tenor’.

In mid-2012, prior to the partial sell-off of the four Crown-owned power companies, an independent energy analyst, Molly Melhuish, who evidently based her research on official data, found that private companies charged 13 per cent more for electricity than their state-owned counterparts. Forebodingly, in mid-July 2012, then-Herald columnist John Armstrong wrote, “Everyone knows the mixed ownership model is nothing other than a halfway house to the power generators eventually falling into private hands.” The closing date for submissions on the Mixed Ownership Model Bill had been 13 April 2012. The recidivist prime number, 13, returned with asset sales.

Also in 2013, four state-owned power generation companies were sold.

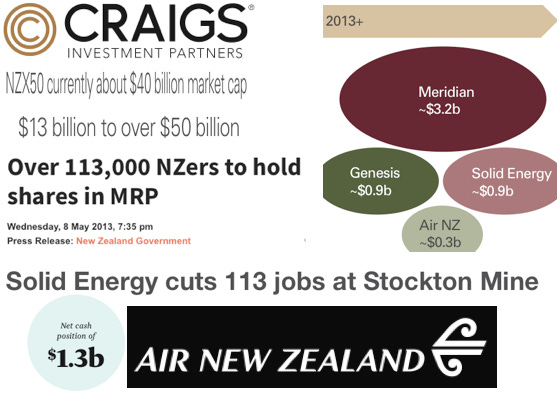

Craigs Investment Partners estimated that the addition of five Crown-owned power companies, Mighty River Power, Genesis Energy, Meridian Energy, coal company Solid Energy — as well as Air New Zealand to the NZ Stock Exchange — would increase the NZX’s market capitalization value by about $13 billion.

At the close of Mighty River Power’s Initial Public Offering (IPO) on 5 May 2013, the power generator magically had 113,000 shareholders. Then, on 28 August 2013, a 3News story about the partially privatized Mighty River Power displayed a graphic showing that the share prices were down from the launch day high. The dates for the share price data were May 13, June 13, July 13 and August 13 2013. Patrick Gower was political editor at 3News, after having shared the Best News Reporter gong with Duncan Garner at the 2012 TV Awards for saving Key over the Teapot Tape Scandal, two weeks out from the 2011 election. Key was outsourcing dirty political attacks.

A few days later, in a Te Kāea news report about assets sales on Māori Television, then-Prime Minister John Key stated that the government already had a referendum mandate, adding arrogantly, “it’s called a general election.” On 23.10.2013, 3News also reported that only 130,000 copies of the Mighty River Power share offer prospectus were sent to potential investors out of 250,000 printed. The Mighty River Power prospectus proposed dividends equating to 13 cents a share. Genesis Energy paid 13c a share in the 2014 financial year. In May 2015, Solid Energy cut 113 jobs at its West Coast Stockton Mine. The recidivist prime number, 13, appeared in Air NZ’s data too.

In 2017, Air New Zealand — which was partially sold in November 2013 — reported cash holdings of $1.3 billion, operating revenue of $2.6 billion (or 2 x $1.3bn), and had achieved cost savings of $113 million. This data occurred on Luxon’s watch as CEO.

Ironically, Air NZ — that Christopher Luxon once led — is a corporate member of NZ Initiative, and is therefore carrying on from its legacy as a corporate member of the Business Roundtable, when Sir Ronald Trotter was director of the national carrier.

Ironically, Tainui Group Holdings is also a corporate member, meaning the corporatized Tainui Waka have allied with their former enemies, the Bank of New Zealand and Bell Gully (formerly Whitaker and Russell), via one of the New Zealand Initiative’s pirate ‘parents’: the New Zealand Business Roundtable.

Moreover, Tainui is rubbing shoulders with the market-monopolizing dairy cartel, Fonterra, and also with Gallagher, a farm stock management firm, which began life in 1938 electric fencing the Waikato as Gallagher Power Fencing. Ironic — because following the defeat of Māori, 1.3 million hectares became Masonic territories in the Waikato, Bay of Plenty and Taranaki. The sales were to pay for the war debt. The Colonial Government didn’t exercise a sovereign power to mint debt-free cash.